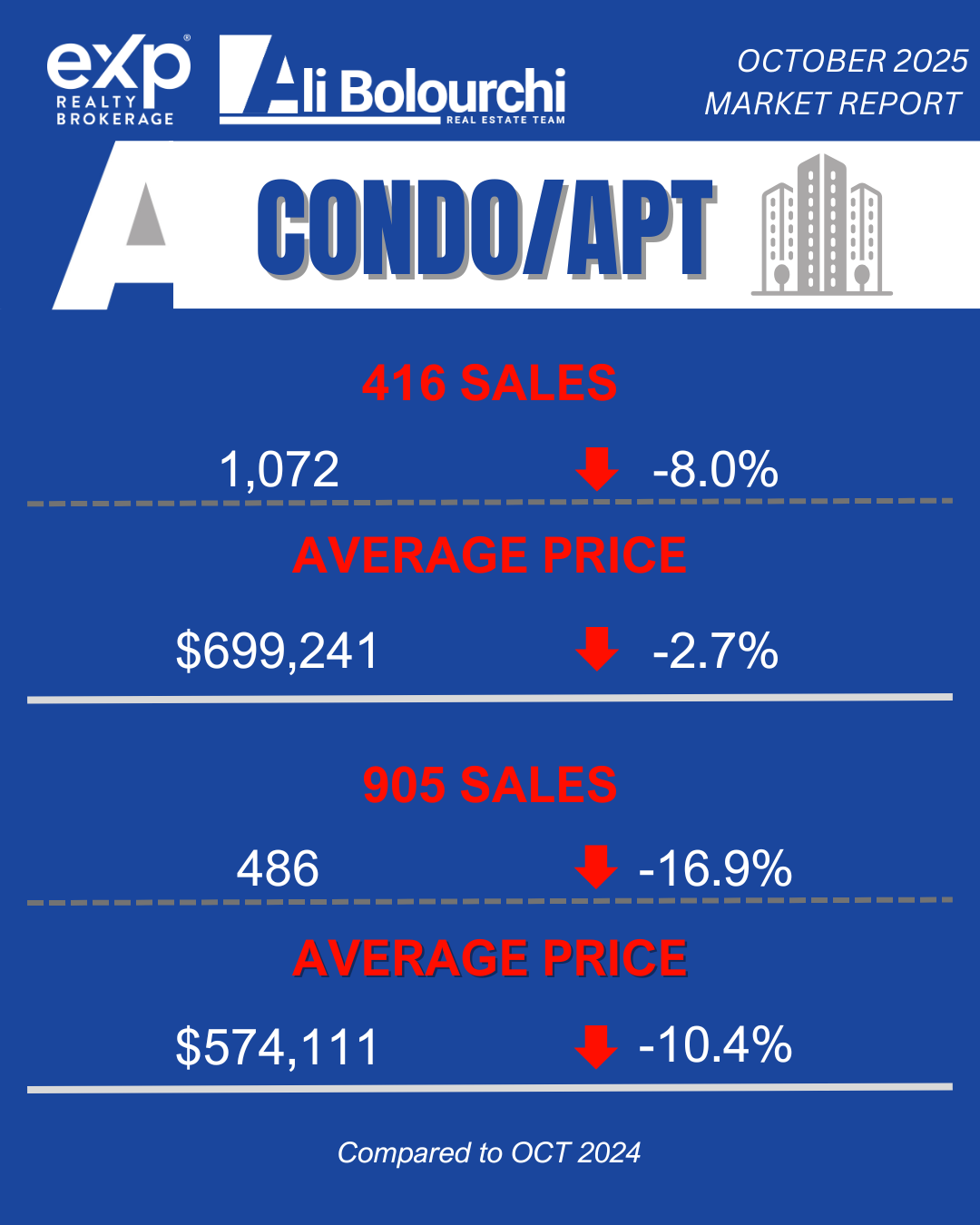

The conventional wisdom among Toronto's young professionals has been dangerously simple: buy the most affordable condo you can find, build equity, then upgrade later. But while your peers are bidding wars over 600-square-foot units in glass towers, the savviest young investors are making a different calculation entirely.

Toronto's luxury townhome market operates under different rules than the mainstream condo market. The regulatory landscape, financing requirements, and investment fundamentals create unique opportunities for high-earning professionals who understand the mechanics.

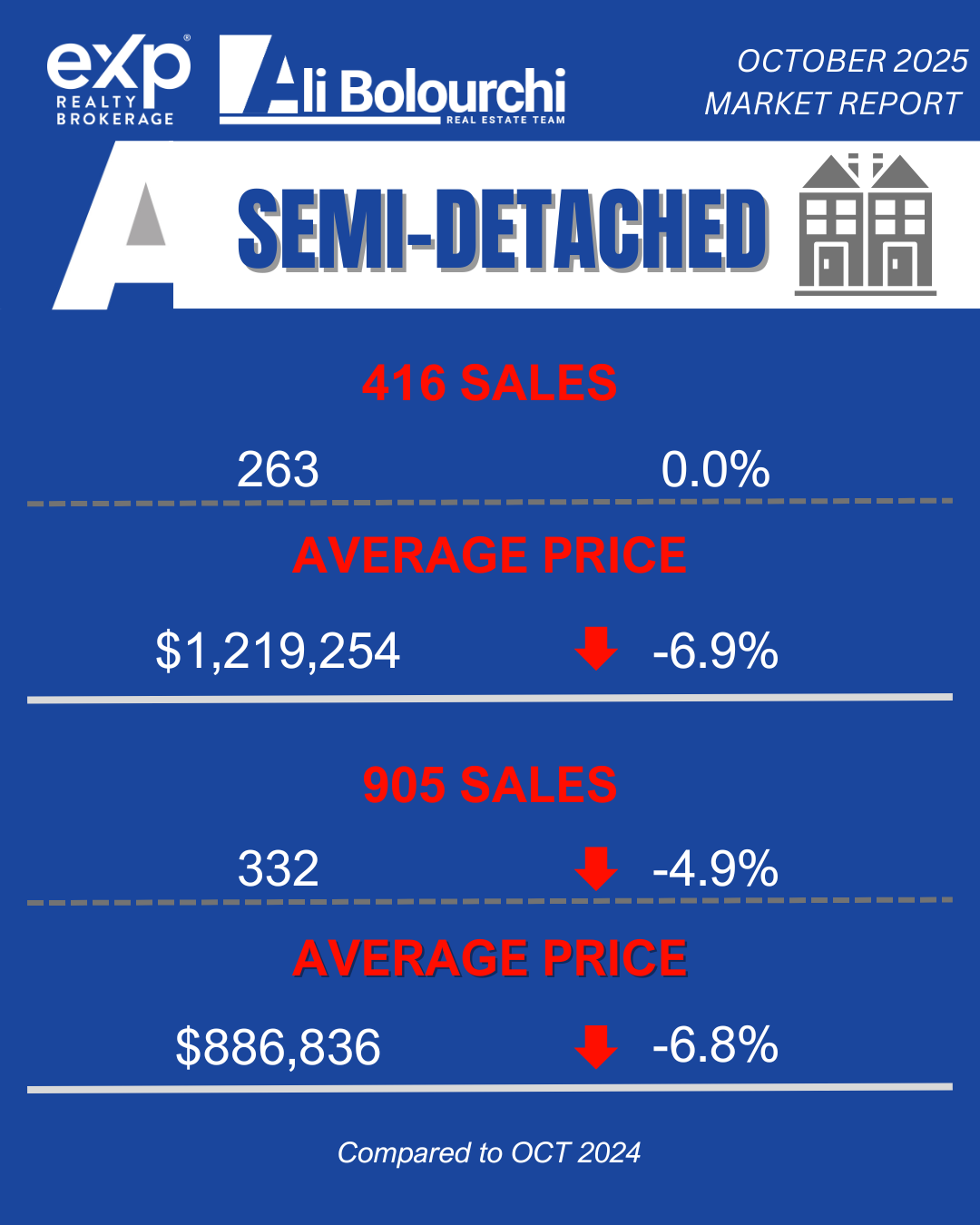

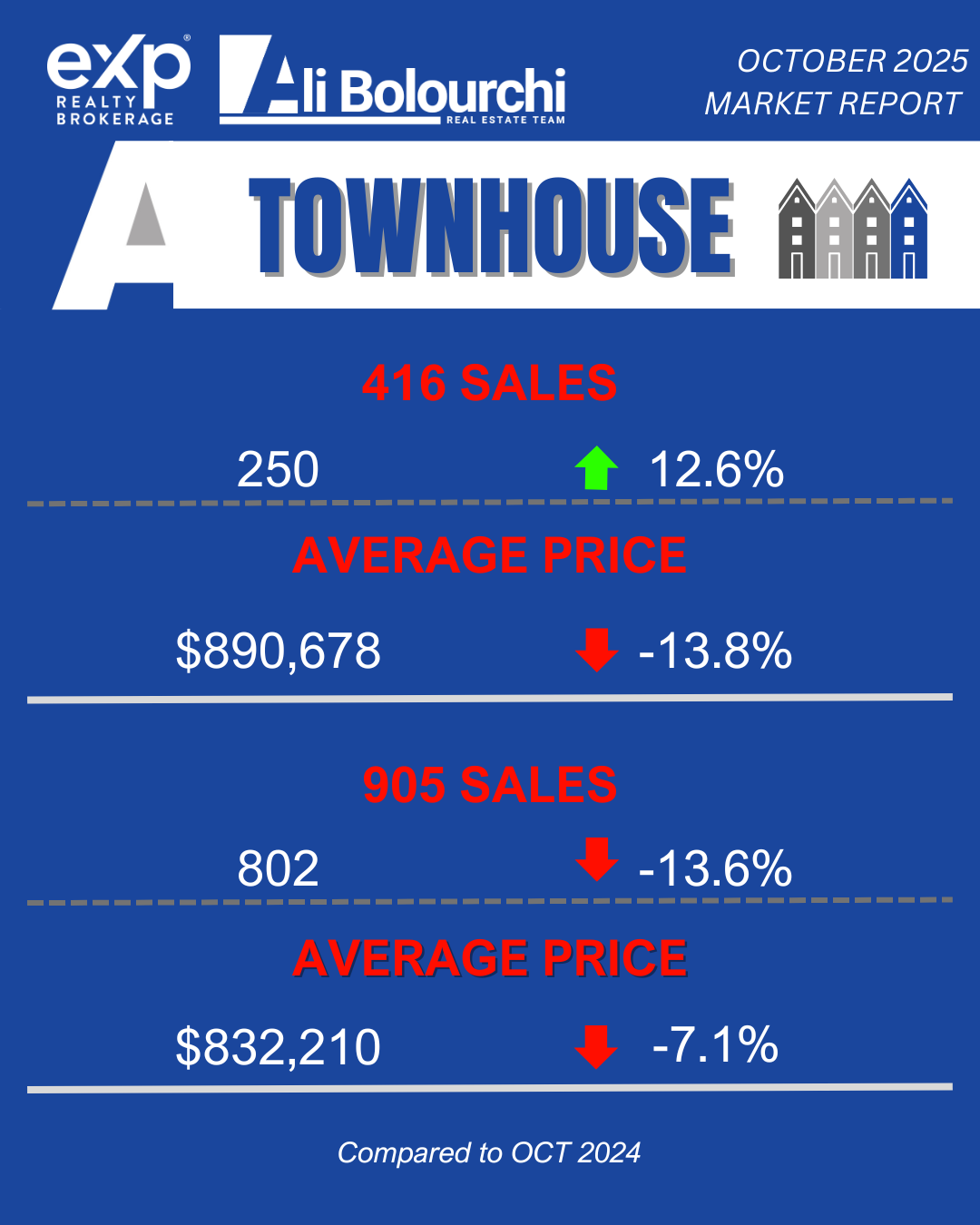

Recent TRREB data from September 2025 reveals compelling market conditions: townhome prices across Toronto have declined 5-7% year-over-year, creating a strategic buying window. Meanwhile, the finite supply of well-located townhomes continues to provide long-term appreciation potential that starter condos simply cannot match.

For Toronto's young elite—the professionals earning $200K+ who are building wealth while building careers—the townhome-first strategy offers immediate lifestyle elevation, superior wealth building potential, and strategic advantages that starter condos cannot match.

This analysis examines the financial realities of luxury townhome acquisition using current market data, the regulatory frameworks that shape this market, and the specific strategies that make this approach viable for high-earning young professionals.

Section 1: The Financial Reality of Luxury Townhome Ownership

Understanding the 20% Down Payment Requirement

TABLE 1: CMHC Insurance Requirements and Costs

Source: CMHC-SCHL.gc.ca

| Purchase Price Range | Minimum Down Payment | CMHC Insurance Available | Insurance Premium Rate |

|---|

| Up to $500,000 | 5% | Yes | 2.8% - 4.0% of mortgage |

| $500,001 - $999,999 | 5% first $500K + 10% remainder | Yes | 2.8% - 4.0% of mortgage |

| $1,000,000+ | 20% (minimum $200,000) | NO | Not Available |

Critical Regulatory Reality:

The Canadian mortgage insurance landscape creates a fundamental divide at the $1 million threshold. Properties priced above $1 million cannot access CMHC mortgage insurance regardless of down payment amount. This means luxury townhomes in Toronto's desirable neighborhoods require conventional financing with minimum 20% down payment.

For properties under $1 million, the mathematics strongly favor the 20% down payment approach. Consider a $950,000 townhome:

10% Down ($95,000): CMHC insurance premium of $22,800 + higher interest rates

20% Down ($190,000): No insurance premium + access to best mortgage rates

The $22,800 insurance premium represents nearly 25% of the additional down payment required, while providing no benefit to the borrower—it protects the lender while adding permanent cost to your purchase.

True Cost of Ownership Analysis

TABLE 2: Monthly Ownership Costs - September 2025 Market Prices

Based on Canadian mortgage calculations: 5.5% semi-annual compounding, 25-year amortization

| Market Segment | Average Price | Down Payment (20%) | Mortgage Amount | Monthly Payment | Total Monthly Cost |

|---|

| Toronto East | $987,505 | $197,501 | $790,004 | $4,634 | $6,151 |

| Toronto West | $1,023,439 | $204,688 | $818,751 | $4,802 | $6,344 |

| Toronto Central | $1,639,760 | $327,952 | $1,311,808 | $7,691 | $10,008 |

Monthly Cost Breakdown:

Mortgage Payment (calculated using Canadian semi-annual compounding)

Property Tax: $660-$1,100 (0.8% annually)

Home Insurance: $200-$300

Utilities: $300-$400

Maintenance Reserve: $400-$550 (0.5% annually)

Section 2: Market Analysis - Current TRREB Data

Toronto Luxury Townhome Neighborhoods - September 2025

TABLE 3: Market Performance by Region

Source: TRREB Market Watch, September 2025

| Region | September Sales | Average Sale Price | Median Price | YoY Price Change | SP/LP Ratio |

|---|

| Toronto Central | 22 | $1,639,760 | $1,425,500 | -6.8% | 97% |

| Toronto East | 36 | $987,505 | $925,500 | -5.1% | 102% |

| Toronto West | 23 | $1,023,439 | $967,500 | -7.2% | 99% |

Market Insights:

Toronto East leads in sales volume (36 units) and buyer competition (102% SP/LP ratio)

Toronto Central commands premium pricing but shows buyer negotiating power (97% SP/LP)

Toronto West offers balanced market conditions with moderate pricing

All segments show 5-7% YoY price declines, creating strategic buying opportunities

Neighborhood Analysis and Transit Access

Toronto Central (C01-C15) - The Premium Choice

Key Areas: Corktown, King West, Entertainment District

Financial District Commute: 5-10 minutes (walk/bike)

Professional Profile: Tech executives, investment bankers, corporate lawyers

Investment Thesis: Maximum appreciation potential, lifestyle premium

Toronto East (E01-E11) - The Value Leader

Key Areas: Leslieville, Riverdale, Beaches periphery

Financial District Commute: 15-25 minutes (TTC)

Professional Profile: Senior tech professionals, consultants, medical specialists

- Investment Thesis: Best value proposition, emerging neighborhood upside

Toronto West (W01-W10) - The Balanced Option

Key Areas: Liberty Village, Junction Triangle, High Park vicinity

Financial District Commute: 10-20 minutes (TTC/GO)

Professional Profile: Finance professionals, startup founders, creative executives

Investment Thesis: Infrastructure development, pre-gentrification opportunities

Section 3: Income Requirements and Qualification Analysis

Mortgage Qualification Framework

TABLE 4: Income Requirements Based on September 2025 Prices

Based on 32% Gross Debt Service ratio and current mortgage rates

| Region | Average Price | Required Down Payment | Monthly Payment | Required Household Income |

|---|

| Toronto East | $987,505 | $197,501 | $4,634 | $217,100 |

| Toronto West | $1,023,439 | $204,688 | $4,802 | $224,900 |

| Toronto Central | $1,639,760 | $327,952 | $7,691 | $360,500 |

Professional Income Context:

High-earning professionals in Toronto who can realistically consider luxury townhomes:

$217K-$225K Required: Senior software engineers, corporate lawyers (5+ years), management consultants, medical residents finishing specialty training

$360K+ Required: Investment banking VPs, tech executives, medical specialists, dual high-income households

Down Payment Accumulation Strategies

TABLE 5: Savings Timeline for High Earners

| Annual Income | After-Tax Income | Savings Rate | Monthly Savings | Time to $200K |

|---|

| $225,000 | $154,125 | 35% | $4,496 | 45 months |

| $250,000 | $168,750 | 40% | $5,625 | 36 months |

| $300,000 | $198,000 | 40% | $6,600 | 30 months |

| $360,000 | $234,000 | 42% | $8,190 | 24 months |

Acceleration Strategies:

RRSP Home Buyers' Plan: Up to $70,000 for couples

Stock Option Exercise: Tech professionals with equity compensation

Annual Bonus Allocation: Finance/consulting year-end bonuses

Family Assistance: Gift or structured loan programs

Portfolio Leverage: Using investment assets as collateral

Section 4: Investment Analysis - Townhomes vs. Starter Condos

Wealth Building Comparison

TABLE 6: 5-Year Wealth Building Projection

| Strategy | Initial Investment | Monthly Cost | Equity Built | Appreciation (3% annual) | Net Position |

|---|

| King West Condo ($750K) | $150,000 | $4,200 | $95,000 | $119,000 | $164,000 |

| Toronto East Townhome ($988K) | $197,500 | $6,151 | $156,000 | $157,000 | $115,500 |

| Toronto West Townhome ($1.02M) | $204,700 | $6,344 | $162,000 | $163,000 | $120,300 |

Note: Net position accounts for opportunity cost of additional down payment invested at 6% annual return

TABLE 7: Real Estate Transaction Costs in Toronto

| Cost Component | Percentage of Sale Price | $1M Property Cost |

|---|

| Land Transfer Tax (Municipal) | 2.0% | $20,000 |

| Land Transfer Tax (Provincial) | 1.5% | $15,000 |

| Legal Fees | 0.5% | $5,000 |

| Real Estate Commission | 5.0% | $50,000 |

| Home Inspection | 0.05% | $500 |

| Total Transaction Costs | 9.05% | $90,500 |

Strategic Implications:

Transaction costs of 9% mean properties must be held minimum 3-5 years to overcome costs through appreciation. This reality supports the townhome-first strategy over starter condo approaches that assume trading up within 2-3 years.

Section 5: Risk Assessment and Market Timing

Current Market Opportunities

September 2025 presents unique buying conditions:

Price Corrections: 5-7% YoY declines improve affordability

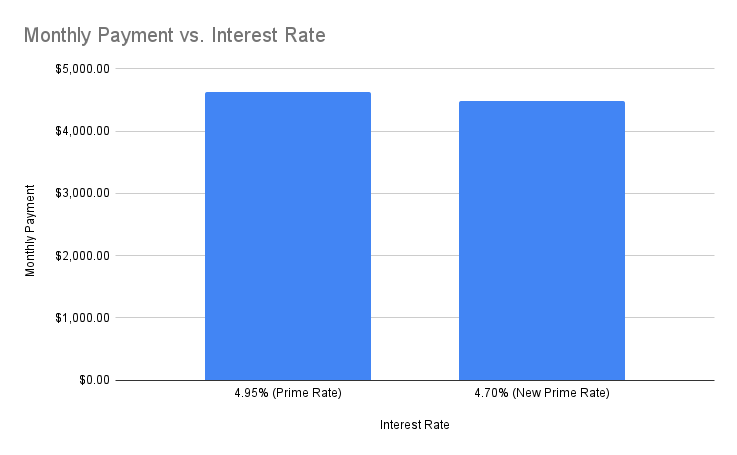

Reduced Competition: Higher interest rates eliminate marginal buyers

Inventory Balance: Healthy sales volumes without oversupply

Rate Environment: Current rates create challenges but also opportunity for future refinancing

Risk Mitigation Strategies

Financial Protection:

Emergency fund: 6-12 months expenses separate from down payment

Income protection: Adequate disability insurance coverage

Property protection: Comprehensive home and title insurance

Market Protection:

Location selection: Established neighborhoods with transit access

Property selection: Move-in ready properties avoiding major renovation risk

Financing structure: Fixed-rate mortgages for payment stability

Section 6: Implementation Strategy

The 90-Day Action Plan

Phase 1: Financial Preparation (Days 1-30)

1. Calculate exact income qualification using current stress test rates

2. Organize financial documentation for mortgage pre-approval

3. Assess down payment timeline and acceleration opportunities

4. Research professional team members (broker, agent, lawyer)

Phase 2: Market Education (Days 31-60)

5. Tour target neighborhoods during different times and days

6. Attend open houses to calibrate expectations and preferences

7. Research recent sales data in target price ranges

8. Interview and select real estate agent with luxury market experience

Phase 3: Active Acquisition (Days 61-90)

9. Secure mortgage pre-approval for specific property targets

10. Begin intensive property search with qualified agent

11. Prepare for competitive bidding in Toronto East market

12. Execute purchase with appropriate conditions and timeline

Property Selection Criteria

Location Factors (40% weighting):

Transit accessibility scores and future infrastructure

Neighborhood appreciation trends and development plans

Walk score for amenities and lifestyle factors

School district quality for future family planning

Property Factors (35% weighting):

Square footage efficiency and layout functionality

Renovation requirements and major systems condition

Parking availability and outdoor space quality

Heritage character and architectural appeal

Investment Factors (25% weighting):

Comparable sales analysis and pricing relative to market

Rental potential assessment for future flexibility

Resale marketability and buyer appeal factors

Price per square foot relative to neighborhood averages

Section 7: Conclusion - The Strategic Advantage

Why Now, Why Townhomes

The September 2025 TRREB data reveals a compelling opportunity for Toronto's young elite. Price corrections of 5-7% have improved affordability while maintaining market fundamentals. For high-earning professionals with the capital and income to execute this strategy, the townhome-first approach offers:

Immediate Benefits:

Lifestyle elevation with space, privacy, and outdoor areas

Professional image enhancement for career advancement

Stability during peak career-building years

Long-term Advantages:

Superior wealth building compared to starter condo strategies

Elimination of transaction costs from trading up

Portfolio optionality as income and family situation evolve

Market Positioning:

Entry into finite supply market with land value appreciation

Positioning in neighborhoods with strong demographic trends

Access to Toronto's most desirable living environments

Your Next Steps

The window for strategic townhome acquisition remains open, but market conditions suggest acting decisively. Young professionals earning $225K+ who can accumulate the required down payment should prioritize:

1. Toronto East for optimal value and appreciation potential

2. Toronto West for balanced pricing and infrastructure upside

3. Toronto Central for maximum lifestyle and prestige benefits

The mathematics are compelling, the market conditions are favorable, and the lifestyle benefits are immediate. For Toronto's young elite who understand wealth building principles, the townhome-first strategy represents the optimal path to real estate success.

Schedule Your Complimentary Consultation

Ready to join Toronto's young elite in building serious real estate wealth through strategic townhome acquisition?

Our luxury market specialists understand the unique challenges and opportunities facing high-achieving young professionals in Toronto's evolving real estate landscape.

Our consultation provides:

Personalized financial qualification analysis based on your specific situation

Current market intelligence and exclusive opportunity identification

Professional team recommendations and strategic introductions

Implementation planning for optimal timing and execution

Book your complimentary consultation to explore how the townhome-first strategy applies to your income, savings, and lifestyle goals.

This analysis is based on September 2025 TRREB market data, current CMHC regulations, and mortgage calculations using Canadian semi-annual compounding standards. Market conditions and pricing change regularly - consult with qualified professionals for current information and personalized advice.