Introduction

Canada’s economy over 2015–2024 experienced mixed performance relative to other G7 nations and major European economies. This report compares Canada’s recent GDP growth, inflation, unemployment, interest rates, trade balance, and housing market indicators with peers including the United States (US), United Kingdom (UK), France, Germany, Italy, Japan, the EU average, and select smaller economies (e.g. Netherlands, Sweden). Each section provides data trends (often visualized in charts or tables) and concise analysis, highlighting where Canada outperforms or lags and offering insights relevant to investors, real estate professionals, and consumers.

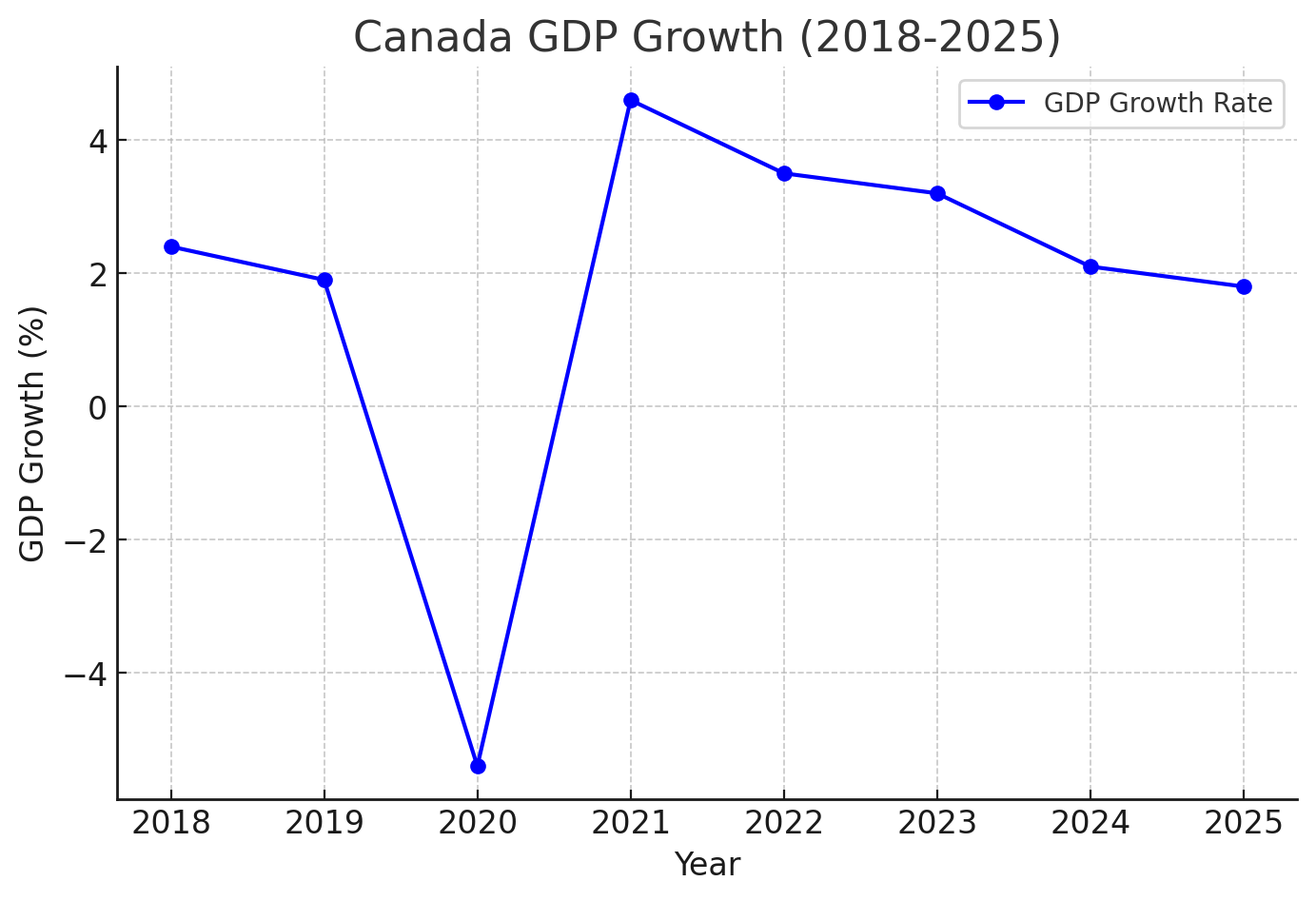

GDP Growth Trends (2015–2024)

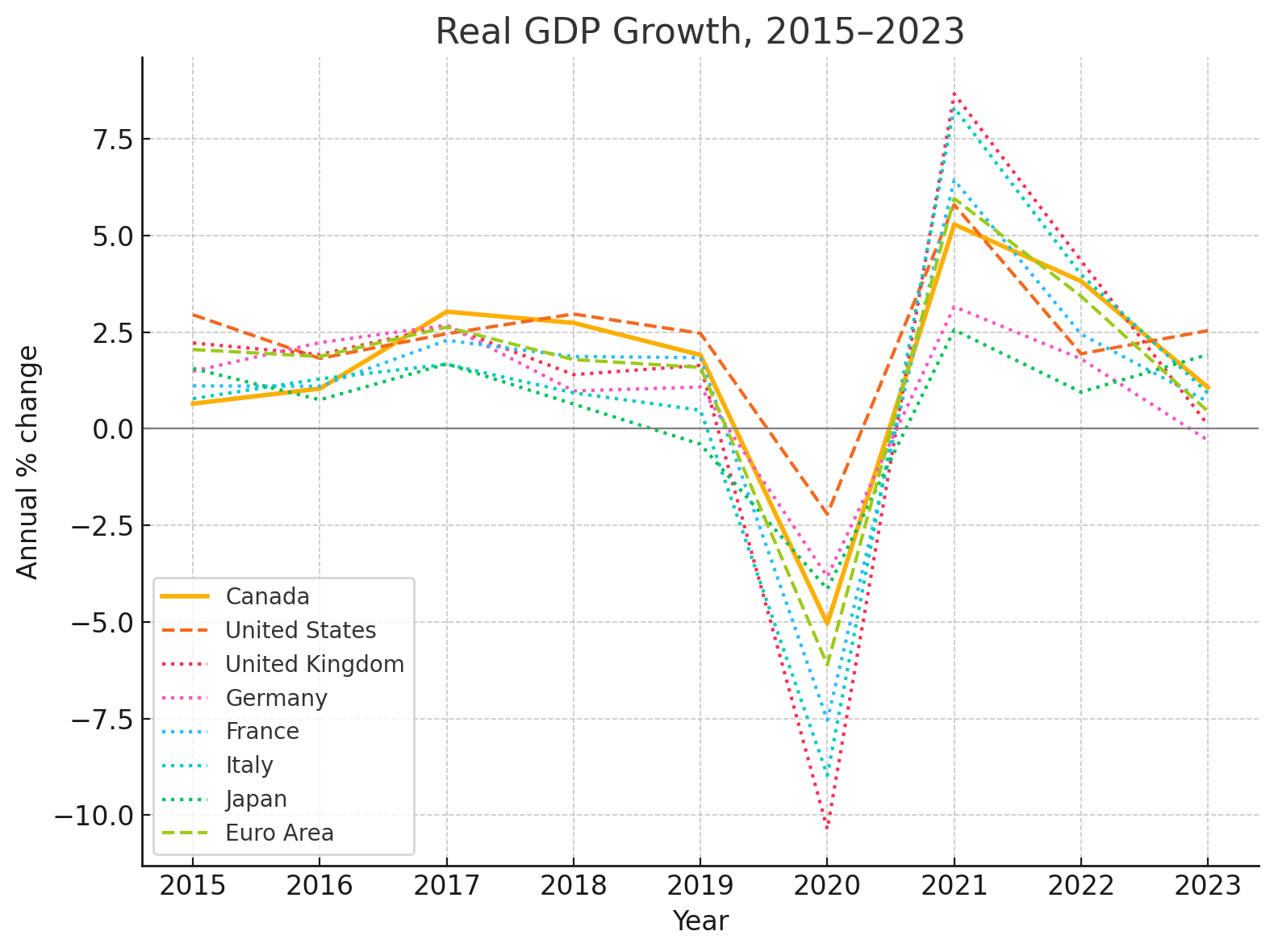

Growth Volatility: All advanced economies saw moderate growth through the mid-2010s, a sharp contraction in 2020 due to COVID-19, and a rebound in 2021. Canada’s real GDP growth swung from a mild +0.7% in 2015 to -5.0% in 2020, then up to +5.3% in 2021, before cooling to 1.1% in 2023. This pattern is similar to peers (see Chart below). The US and UK had slightly stronger expansions pre-2020 but also sharper 2020 contractions (e.g. UK -10.4%, US -2.2% in 2020), followed by vigorous rebounds in 2021 (UK +8.7%, US +5.8%). The euro-area economies like Germany and France saw 2020 GDP declines around -7% to -8%, with robust 2021 recoveries (+6%). Japan had a smaller 2020 drop (-4.2%) and more subdued recovery, reflecting longstanding low growth. By 2022–2023, growth normalized to low single-digits across the board, with Canada at +3.8% (2022) then +1.1% (2023) – comparable to the US (+1.9% in 2022, +2.5% in 2023) and above Europe’s near-stagnation in 2023 (Eurozone +0.45%, UK +0.1%, Germany -0.3%). macrotrends.net

Real GDP Growth (% annual change), 2015–2023 for Canada vs G7 & Euro Area.

Source: World Bank data via Macrotrends macrotrends.net

Relative Performance: Cumulatively, Canada’s GDP grew solidly in this period (thanks in part to rapid population gains). In fact, Canada had the second-highest total GDP growth in the G7 over the last decade, behind only the U.S., when not adjusting for population. This outpaced European peers – e.g. Germany’s economy expanded about 5% total (2014–2024) while the U.S. grew 16%. However, on a per-capita basis Canada’s growth was weakest in the G7, essentially “a lost decade” with only ~0.7% total rise in GDP per person since 2014 (a consequence of surging population). By contrast, U.S. GDP per capita is ~16% higher than a decade ago nbc.ca.

In 2022–2023, Canada’s growth (~3–4% then ~1%) was middle-of-pack: stronger than Germany (which fell into mild recession in 2023 at -0.3% macrotrends.net) and the UK (barely above zero in 2023 macrotrends.net), but lagging the US (which maintained ~2%+ growth) macrotrends.net. Smaller European economies like the Netherlands and Sweden (not in G7) also slowed markedly by 2023 amid global headwinds. Overall, Canada recovered well from the pandemic shock – its 2021 GDP jump (+5.3%) was one of the larger among advanced economies macrotrends.net – but momentum eased with tighter monetary conditions.

Inflation Rates and Monetary Policy

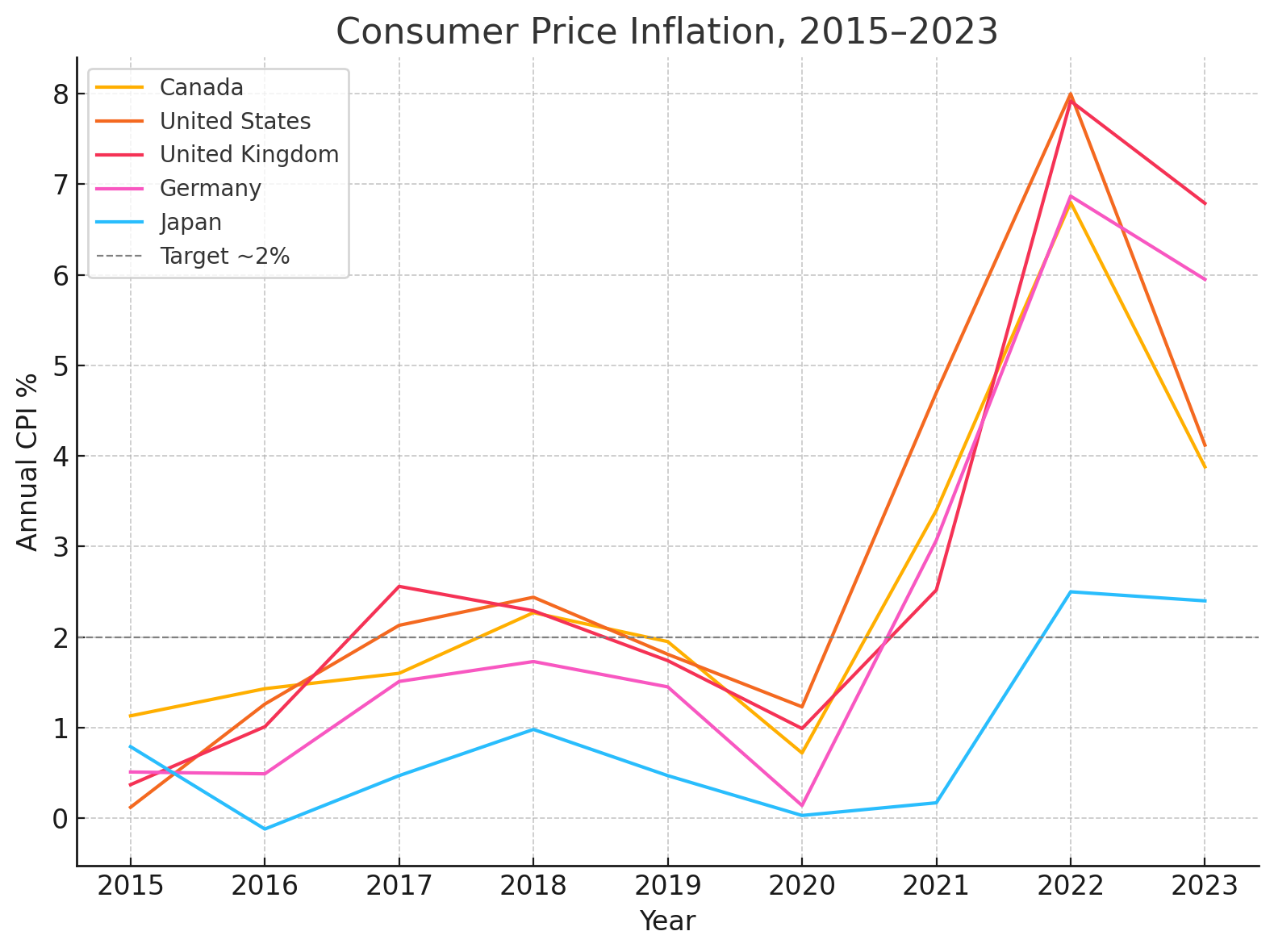

Inflation Surge and Retreat: Inflation in Canada remained low and near the 2% target for much of 2015–2019 (CPI ~1–2%), similar to the U.S., UK, and Eurozone which also saw sub-2% inflation pre-2020. In 2020, pandemic effects briefly pushed inflation down (Canada +0.7%, euro-area ~0%, UK ~1.0%). However, by 2021–2022 inflation spiked globally as economies reopened and supply shocks hit. Canada’s CPI inflation hit 6.8% in 2022, the highest in 40 years, before easing to 3.9% by 2023. This peak was slightly lower than in the US (8.0% in 2022) and UK (7.9% in 2022), but higher than France (~5.2% in 2022) or Japan (~2.5% in 2022, given Japan’s more moderate pressures). Notably, the UK saw the highest inflation in the G7, reaching about 8–9% in 2022 (a result of energy price spikes and Brexit-related factors). The Eurozone average in 2022 was ~8.4% (HICP), with Germany peaking at 6.9% (2022 annual CPI) and Italy ~7%. By 2023, inflation was cooling but still above central bank targets: Canada ~3.9%, US ~4.1%, euro-area ~5.5%, UK ~6.8%. Meanwhile, Japan’s inflation — after years of near-zero deflation — rose to ~2–3% by 2023 (a notable increase, though still lowest in the group) macrotrends.net.

Consumer Price Inflation (annual %), 2015–2023 for Canada vs select peers.

Sources: World Bank data via Macrotrends macrotrends.net.

Interest Rate Responses: To combat the inflation surge, central banks undertook aggressive tightening in 2022–2023. The Bank of Canada (BoC) had kept its policy rate low (0.5–1% range) through late 2010s, cut to 0.25% in 2020, then began one of its fastest hiking cycles on record. By early 2023 the BoC’s overnight rate reached 5.0%, its highest since 2001. Similarly, the U.S. Federal Reserve raised its benchmark from near 0% to a range of 5.25–5.50% by 2023, outpacing even Canada bankofcanada.ca.

The Bank of England (BoE) hiked from 0.1% in 2021 to 5.25% in 2023, a 15-year high, as UK inflation was persistently elevated. The European Central Bank (ECB), which had kept rates at historic lows (0% main refi rate, deposit facility -0.5%), executed 10 consecutive hikes starting mid-2022, reaching a record-high 4.0% deposit rate in Sept 2023 reuters.com.

In contrast, the Bank of Japan maintained its ultra-low policy (around -0.1% to 0% rates) throughout, given Japan’s lower inflation – only in late 2023 did it signal slight tightening. Overall, Canada’s interest rate environment tracked the U.S. closely; by early 2024 Canadian and U.S. policy rates were both around 5% bankofcanada.ca. This rapid tightening cooled demand and housing (discussed later), helping inflation rates fall back toward ~3–4% by late 2023. Central banks in North America paused hikes by end-2023, whereas the ECB (slower to start) only peaked in late 2023 reuters.com. These interest rate moves have significant implications for consumers (e.g. higher mortgage costs) and investors (e.g. bond yields) across all countries.

Unemployment and Labor Market

Pre-Pandemic Trends: Canada’s labor market improved through 2015–2019, with the unemployment rate falling from ~7.0% in 2015 to 5.7% in 2019. This mirrored the US (down from 5.3% to 3.7% over the same period) macrotrends.net and the UK (from ~5.3% to 3.8%) statista.com.

Major EU economies started with higher joblessness – e.g. France ~10% in 2015, Italy ~11.9% in 2015 – but also saw steady declines to multi-decade lows by 2019 (France ~8.4%, Italy ~9.9%). Germany maintained the lowest unemployment in Europe, around 3–4% by 2019 macrotrends.net, thanks to strong industry and labor reforms. Japan consistently had the lowest unemployment of all, about 2.4% in 2019 macrotrends.net. Canada’s unemployment rate in 2019 (5.7%) was slightly above the G7 average, but still the country’s best in decades, reflecting a tight labor market.

COVID Shock and Recovery: The pandemic disrupted labor markets globally in 2020. Canada’s unemployment spiked to 9.6% in 2020, the highest on record, as lockdowns led to unprecedented job losses (the monthly peak reached 13.7% in May 2020). The US saw a similarly stark rise (annual average 8.1%, with a one-month peak ~14.8%) macrotrends.net.

European jobless rates increased more modestly in 2020 (e.g. Germany ~4.0% macrotrends.net, France ~8.0%, Italy ~9.3%) because extensive furlough schemes buffered employment. The UK’s rate rose to ~4.5%tradingeconomics.com, tempered by its Job Retention Scheme. By 2022–2023, labor markets recovered: Canada’s unemployment fell back to 5.3% in 2022, near its pre-pandemic low. The US returned to 3.6% by 2023, essentially full employment . The UK stabilized around 4.0% statista.com. Germany and Japan stayed exceptionally low (~3% or below) – in fact, Germany hit about 3.0% unemployment in 2023 macrotrends.net, and Japan ~2.6% data.worldbank.org. Southern Europe remains higher (Italy 7.6% in 2023, though down from double-digits macrotrends.net).

Canada’s unemployment ticked up slightly to ~5.4% in 2023, partly as rapid immigration expands the labor force. But overall, Canada’s jobless rate is now very close to the U.S. and better than the OECD/G7 average of ~4.8% macrotrends.net.

Unemployment Rate (% of labor force), 2015–2023 for Canada and G7 peers.

Source: World Bank/ILO data (national definitions) macrotrends.net. Note: Eurostat definitions may differ.

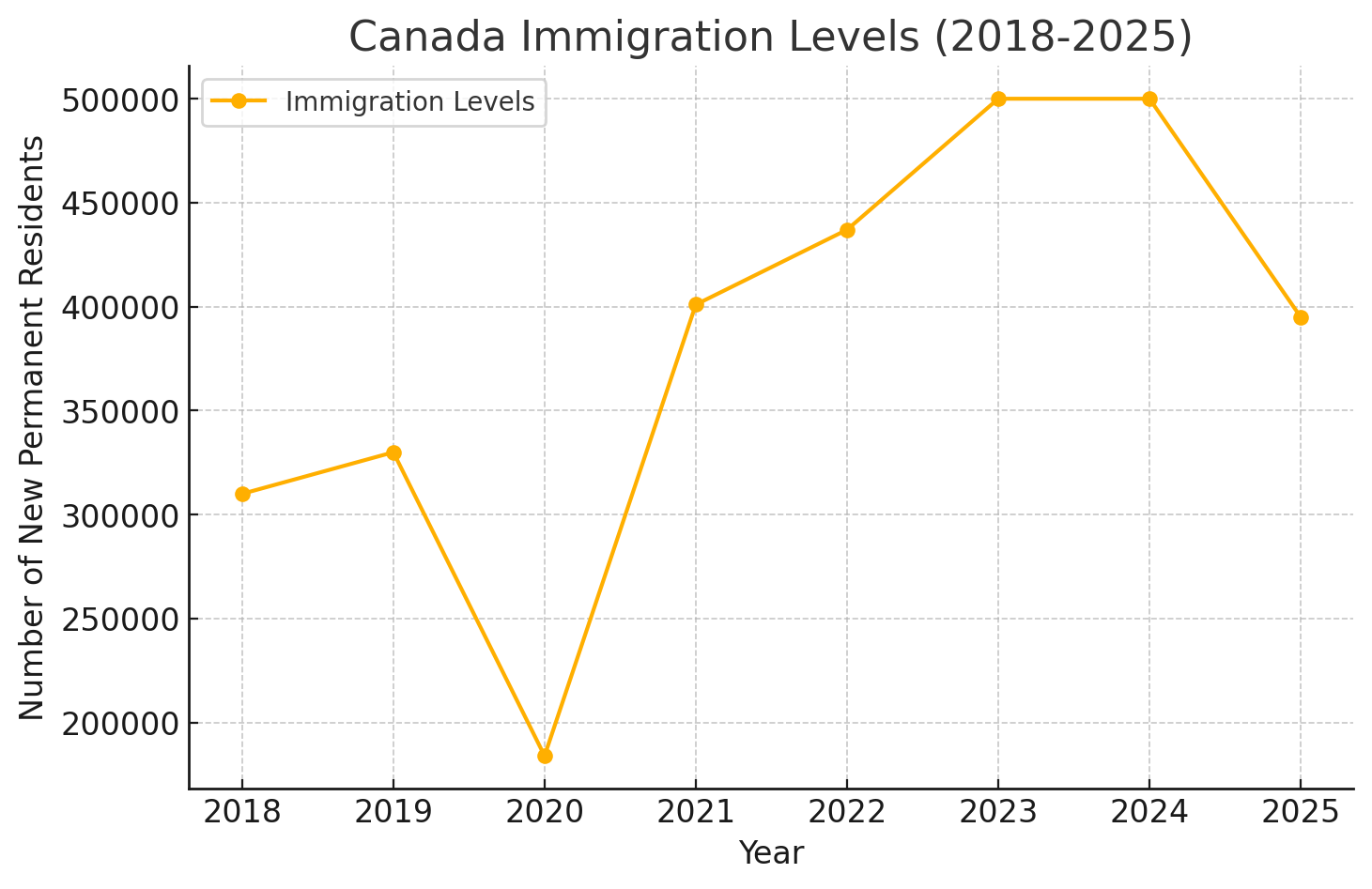

Labor Force & Wages: A noteworthy trend is Canada’s exceptionally strong population and labor force growth in recent years. Canada’s population grew 3.2% in 2023 – by far the fastest in the G7 (U.S. was ~0.5%) thehub.ca – fueled by record immigration. This has boosted labor supply and kept unemployment from falling further, even as jobs grow.

Other G7 countries have aging or slower-growing populations, which could lead to labor shortages; for example, Japan’s working-age population is shrinking, keeping unemployment low but limiting growth.

Wage growth accelerated in all countries amid post-pandemic labor demand. By 2023, nominal wage gains in Canada (~5%) were similar to the US and UK, though below inflation for part of the period (real wages were squeezed in 2022). Europe saw more moderate wage rises.

For investors, tight labor markets mean potential cost pressures, while for workers they have improved bargaining power – except in Canada, where the influx of workers may be easing wage pressures relative to peers.

Trade Balance and External Accounts

Canada’s Trade Balances: Canada’s trade balance has been near breakeven in recent years, oscillating between modest deficits and surpluses. In the mid-2010s, Canada ran small trade deficits as low commodity prices hurt exports. By 2021–2022, a commodities boom (energy, metals) swung Canada into a slight surplus. In 2022 Canada recorded a $2.8 billion trade surplus (goods & services) – tiny relative to GDP (~0.1% of GDP) but notable as a first surplus in over a decade. This reversed to a small deficit of about $8.4 billion in 2023 as energy prices fell. In essence, Canada’s trade has been roughly in balance, unlike the huge imbalances seen in some other G7 economies.macrotrends.net

Deficit vs Surplus Countries: The United States persistently runs the largest trade deficits. In 2022 the U.S. trade deficit hit $971 billion (goods & services) macrotrends.net – about 3.7% of GDP – reflecting America’s high consumption and import reliance (especially on consumer goods and oil). It was the widest US deficit on record, though it narrowed slightly in 2023 as domestic demand cooled.

The UK also runs chronic deficits (e.g. a total trade deficit of £53 billion in 2023 in goods/services excluding precious metals ons.gov.uk, ~2% of GDP), reflecting weak export growth post-Brexit and strong import demand. On the other side, export-driven economies like Germany and Japan have maintained trade surpluses, though these have fluctuated. Germany traditionally ran very large surpluses (e.g. $230 billion in 2021, ~6% of GDP), thanks to strong manufacturing exports. However, surging import costs (especially energy) cut Germany’s surplus to about $80 billion in 2022 and it remained lower in 2023 – an important shift. Japan usually has a goods surplus offset by an energy import deficit; its current account stays positive due to investment income. Italy moved from deficits to a modest surplus of ~$31 billion by 2023 (about 1.5% of GDP), buoyed by exports of machinery and a tourism rebound. France continues to run deficits (its goods trade is deeply negative, partly offset by services like tourism; 2023 total deficit around €15 billion per Statista). The EU as a whole had a small surplus pre-2022, but higher energy import bills turned the EU trade balance slightly negative in 2022 before recovering in late 2023 as gas prices fell. macrotrends.net

Insight: Canada’s balanced trade position appears relatively healthy; it avoided the massive deficits of the US/UK (reducing external vulnerability), but also doesn’t enjoy the export surpluses of Germany or Japan. For Canada, high import demand (especially for consumer goods and autos) tends to absorb export revenues. A positive note is diversification: Canada’s exports (energy, commodities, and increasingly services) largely kept pace with imports. Going forward, trade may shift with new agreements (e.g. CPTPP) and commodity cycles. Investors note that Canada’s current account is roughly neutral, so the Canadian dollar’s value has been driven more by commodity prices and interest rate differentials than by huge trade imbalances.

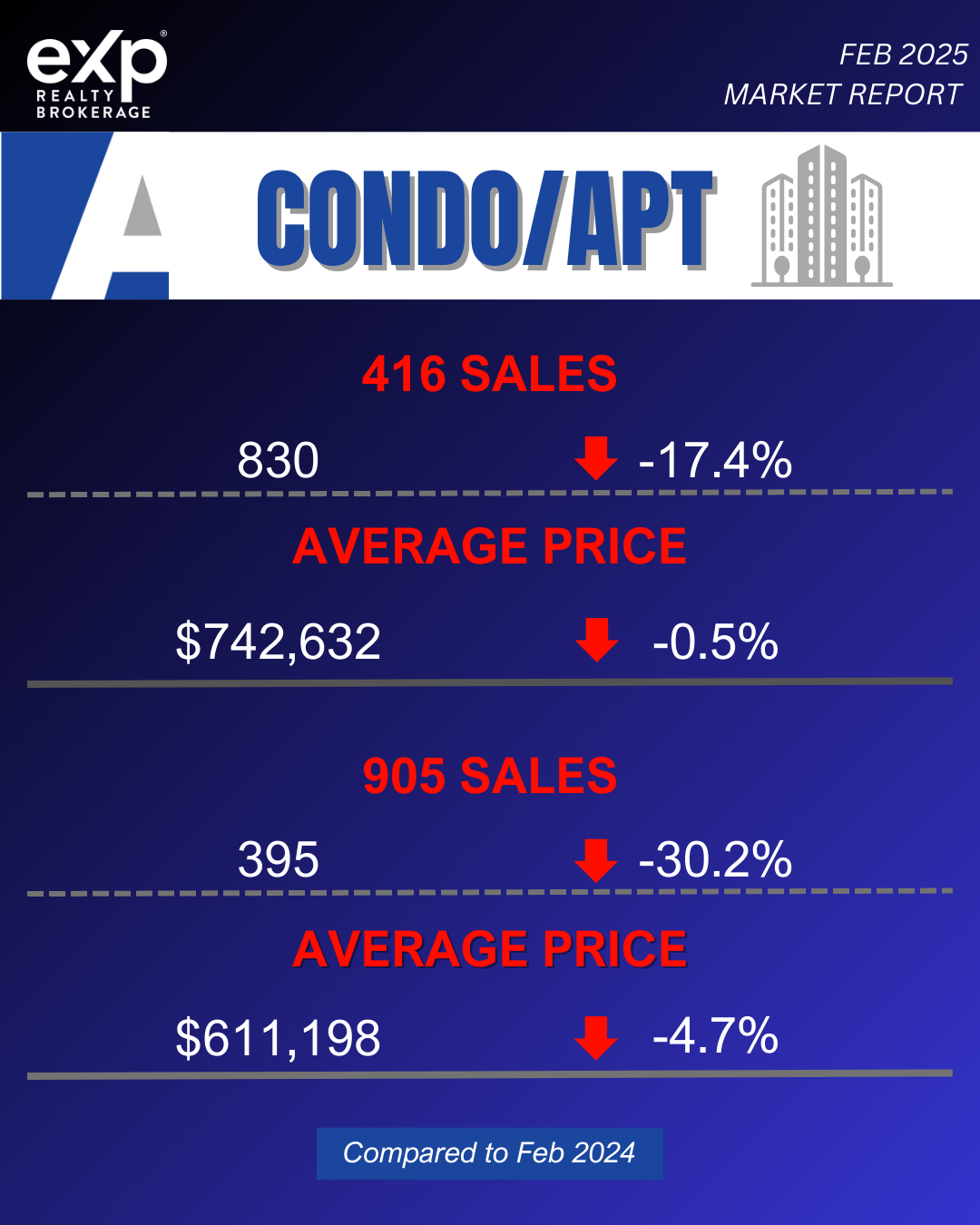

Housing Market Indicators

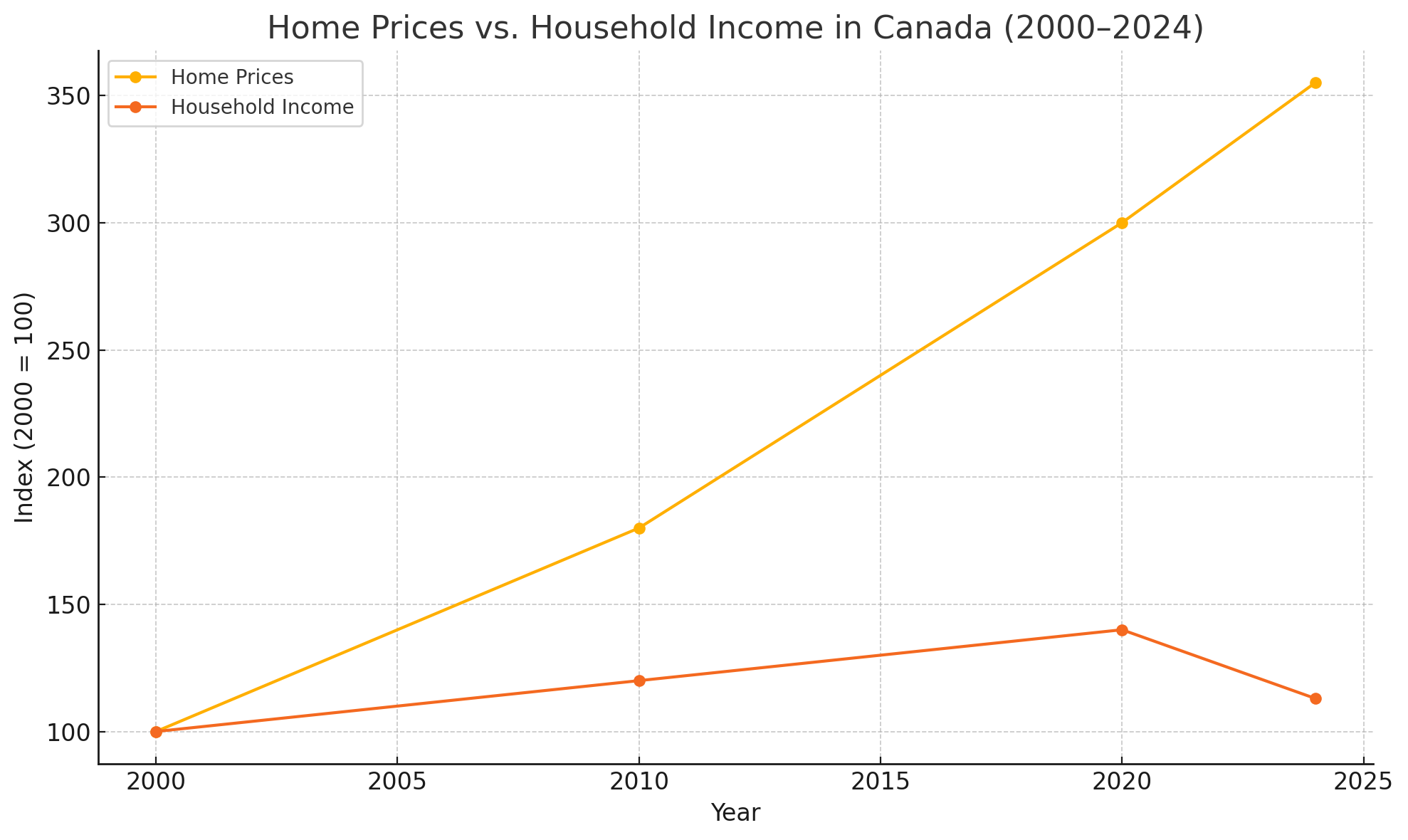

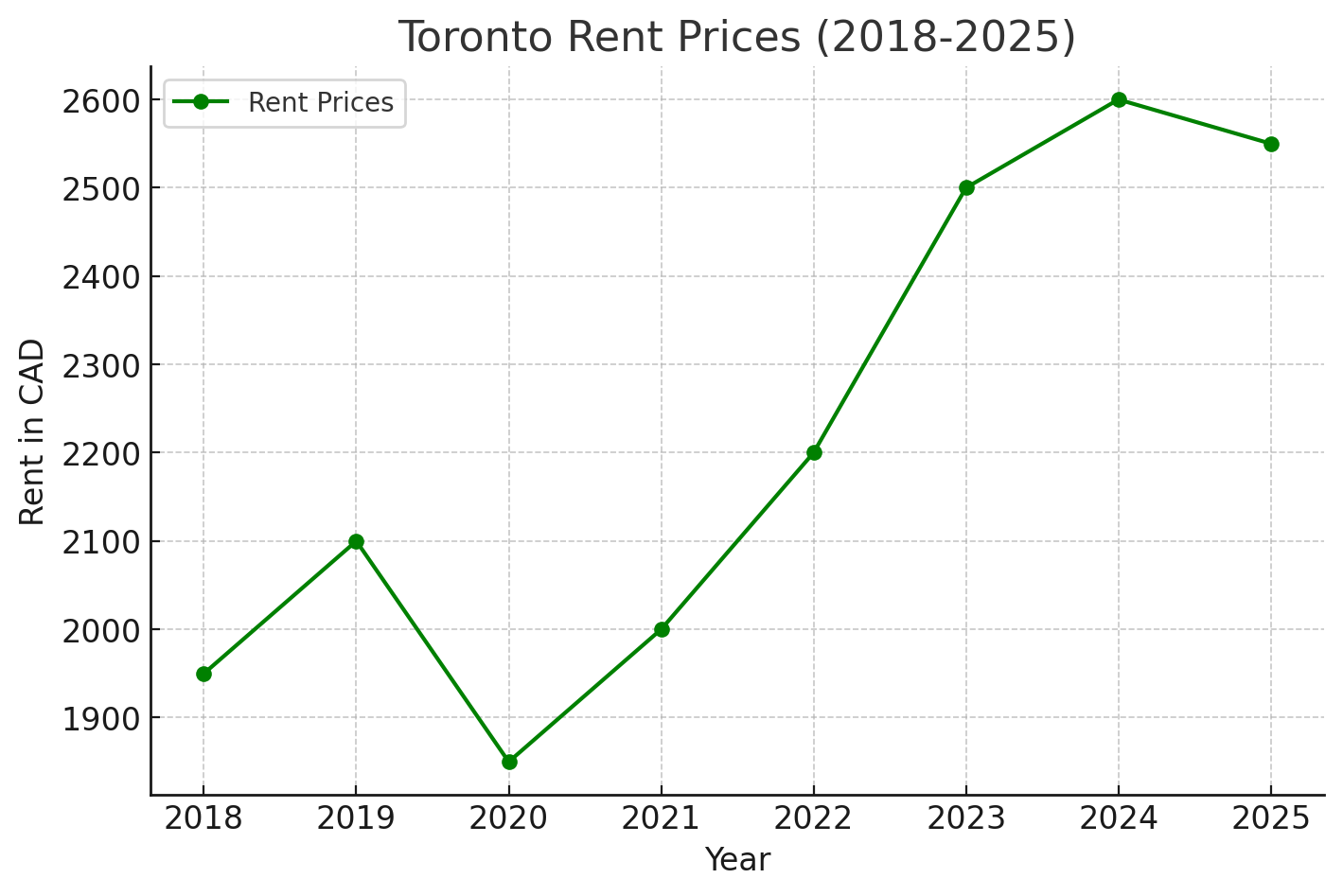

Home Price Boom: Canada’s housing market saw extraordinary growth over the past decade, far outpacing other G7 countries. From 2015 to the peak in early 2022, Canadian home prices roughly doubled. The Parliamentary Budget Officer noted the average house price in Canada rose 97% from Jan 2015 to Dec 2021 policyoptions.irpp.org. Even after a correction in 2022–2023, prices remain very elevated. This increase dwarfs price gains in most peer countries. For example, since 2005 Canada’s home prices are up ~207%, compared to ~88% in the U.S., ~84% in the UK, ~75% in Germany, ~54% in France, and essentially zero growth in Italy and Japan. No other G7 country has experienced a housing price surge as steep as Canada’s. During the pandemic, ultra-low interest rates and increased housing demand pushed Canadian prices up +59% in just 2020–Q1 to 2022–Q1. (In comparison, U.S. prices jumped ~40% in that period, and some European markets 15–30%.) A slight price decline in 2022 (Canadian prices fell ~16% from the peak by early 2023) did little to erode the enormous gains. This rapid appreciation has eroded affordability and made Canada’s housing market a key concern for consumers and policymakers. betterdwelling.com

Affordability and Debt: Housing affordability in Canada is among the worst in the G7. By 2022, Canadian housing costs relative to incomes reached record extremes. The Bank of Canada’s Housing Affordability Index hit 0.488 at end-2022, meaning a representative household would need to spend nearly 49% of its disposable income on housing (ownership costs) – the highest since 1991 policyoptions.irpp.org. In Toronto or Vancouver, that ratio is even higher. For context, the BoC considers the long-run average HAI to be around 0.3–0.35. Other G7 countries have seen affordability deteriorate too (the U.S. and UK experienced sharp mortgage cost increases in 2022–23), but Canada stands out. An IRPP study remarked “Canada has some of the highest housing prices compared to income in the G7,” creating an affordability crisis impacting quality of life policyoptions.irpp.org. House price-to-income and price-to-rent ratios in Canada are at or near the top globally. Consequently, Canadian household debt has swollen to ~185% of disposable income, the highest in the G7 www150.statcan.gc.ca, largely due to mortgages. This leverage makes households and the housing market more sensitive to interest rate changes. Indeed, the BoC’s rapid rate hikes in 2022–23 have cooled home sales and caused home prices to dip, albeit modestly compared to prior gains.

Housing Supply: A major driver of Canada’s housing challenge is insufficient supply relative to population growth. Housing construction did ramp up – 2021 saw 271,000 housing starts in Canada, the most in 50 years – but it still fell short of population needs. Over 2021–2023, Canada completed roughly 800,000 new housing units, while its population grew by over 2.5 million. This imbalance (roughly 0.32 new homes per person added) has exacerbated housing shortages and kept prices high. thehub.ca

By comparison, no other G7 nation has had to house such a fast-growing populace. The U.S. built over 4 million housing units in the same period for a population growth of ~2 million (2 homes per person added), and most European countries had very slow population growth (or even decline) easing housing demand pressure. Canada’s federal housing agency (CMHC) projects housing starts will actually fall to ~224,000 in 2024, widening the supply gap further as immigration remains robust. This is a crucial issue for real estate professionals and investors – strong demand and limited supply suggest Canadian home prices may stay elevated (or resume rising) barring a major downturn. The government has acknowledged this, with recent policies aiming to spur construction and temper demand (e.g. a two-year foreign buyer ban, higher immigration targets tied to housing commitments). However, structural solutions (zoning reform, speeding up development) will take time. thehub.ca

International Comparison: Other G7 housing markets vary. The US had a notable house price run-up (~45% rise 2015–2022) but from a lower base after its 2008 crash; U.S. affordability, while worsening, remains better than Canada’s (e.g. 30-year fixed mortgage rates cushion existing owners). Germany and France saw steady but modest price growth (total ~30–40% over decade) and still have more affordable ownership ratios, partly due to cultural preferences for renting. UK prices rose substantially in southern England but nationwide gains (~50% since 2015) were below Canada’s, and UK affordability is slightly better than Canada’s (though still poor). Japan and Italy have had almost flat home prices for years, reflecting aging populations and stagnant demand – a stark contrast to Canada’s boom. Smaller economies like Sweden and Netherlands experienced sharp price increases similar to Canada’s, but also saw price corrections of ~10–15% in 2022–23 as rates climbed. Overall, Canada’s housing market stands out for its speed and scale of price appreciation, making it more vulnerable to interest rate shocks but also potentially rewarding real estate investors with strong long-run returns – if, and this is key, affordability issues don’t trigger a policy or market correction.

Conclusion and Outlook

Over the last decade, Canada’s economy has grown solidly in aggregate – roughly matching the G7 leaders – but this was achieved largely through population expansion rather than productivity gains. In per-capita terms Canada underperformed nbc.ca, which is a concern for sustainable improvements in living standards. Relative Strengths: Canada navigated the COVID shock robustly, with one of the quickest jobs recoveries and moderate GDP growth in 2022–23 while Europe faltered. It avoided the extreme inflation of the UK or the deep 2023 recession of Germany. Canada’s fiscal and debt metrics remain healthier than many peers (net debt ~14% of GDP vs G7 average ~104% budget.canada.ca). Its trade balance is roughly neutral, insulating it from external imbalances that plague deficit countries like the US and UK. And its banking system has proven resilient, even as interest rates jumped.

Relative Weaknesses: Canada faces a housing affordability crisis and high household debt, more severe than elsewhere in the G7. Rapid population growth without commensurate housing supply is stretching affordability and could constrain consumer spending as more income goes to shelter. Productivity and business investment in Canada lag peers, contributing to subpar per-capita GDP growth nbc.ca. For investors, this means Canada’s long-term growth potential may rely on continual population inflows – a model that carries social and infrastructure challenges. Additionally, Canada is heavily exposed to commodity cycles; while current account neutral now, a downturn in commodity prices can weaken GDP and the loonie (as happened in 2015–2016).

Insights for Stakeholders: For investors, Canada’s relative macro stability (low public debt, decent growth, strong banking sector) is a positive, but they should watch for the drag of low productivity and high private debt. Sectors like real estate and consumer finance are more fragile given elevated home values and interest rates. Real estate professionals can expect demand for housing to remain intense (thanks to immigration targets of ~500k+ per year), supporting prices especially in major cities – unless supply markedly improves or rates stay high enough to further soften demand. Indeed, Canada’s market has shown resilience; even at 5% mortgage rates, a supply-demand mismatch persists. However, developers face challenges from higher financing costs and construction bottlenecks. Consumers enjoyed a strong job market and rising home equity in the past several years, but now grapple with higher inflation (eroding purchasing power in 2022) and higher interest costs. Canadians with variable-rate mortgages have been especially squeezed by the BoC’s hikes. The good news is inflation is receding and central banks are nearing rate peaks, which should stabilize real incomes in 2024. Unemployment remains low, so job security is solid.

In summary, Canada’s 2015–2024 economic story is one of solid headline growth, low unemployment, and a red-hot housing market, offset by higher inflation in recent years and worsening affordability. Compared to its G7 and European peers, Canada stands near the top on aggregate GDP growth nbc.ca, middle-tier on inflation (better than the UK, worse than Japan), and roughly average on unemployment – but an outlier on housing costs. Investors and policymakers will be watching whether Canada can improve productivity and supply (houses, infrastructure) to support its expanding population. If successful, Canada could translate its demographic growth into a sustained economic advantage. If not, the relative gains of the past decade may be harder to maintain in real terms. The next few years will be pivotal, but as of 2024 Canada’s economy remains fundamentally robust, if not without its challenges, in the G7 context.

Sources: Key data sourced from the World Bank, IMF, OECD, national statistical agencies, and central banks. Notable references include World Bank Open Data for GDP/inflation macrotrends.net, IMF and national reports for interest rates bankofcanada.ca, reuters.com, Statista/ONS for trade and labor figures ons.gov.uk, statista.com, and research by National Bank and IRPP on comparative growth and housing affordabilitynbc.ca, policyoptions.irpp.org. These provide a comprehensive, up-to-date basis for the analysis presented.

With help of ChatGPT