“Don’t work harder. Work smarter—at scale.”

— Every successful investor, ever.

Understanding the Economy of Scale: Why Bigger Often Means Better

In business, growth isn’t just about becoming bigger—it's about becoming more efficient.

That’s where the concept of Economy of Scale comes into play.

Simply put, Economy of Scale is the cost advantage that businesses (or operations) achieve when they increase production or size. As a company (or system) grows, its costs per unit often decrease, boosting profitability and competitive strength.

📚 What Is the Economy of Scale?

Definition:

The Economy of Scale occurs when an increase in output leads to a reduction in the average cost per unit produced.

This happens because fixed costs (like rent, salaries, and equipment) are spread over more goods or services, and variable costs (like raw materials or shipping) may also be reduced through efficiencies or bulk buying.

📈 Real-World Example

Imagine two bakeries:

Bakery A produces 100 loaves of bread a day.

Bakery B produces 10,000 loaves a day.

Because Bakery B can buy flour in massive bulk, use larger ovens more efficiently, and streamline labor costs, its cost per loaf is much lower than Bakery A's.

Result:

Bakery B can either make a bigger profit per loaf or offer a lower price to customers while maintaining healthy margins.

Types of Economies of Scale

There are two main types:

1. Internal Economies of Scale

Cost savings that happen within a company.

Examples:

Bulk purchasing discounts

Specialized employees

Technological efficiencies

Managerial expertise improving operations

2. External Economies of Scale

Cost savings that happen outside a company but within the same industry or community.

Examples:

Development of supplier networks nearby

Skilled labor pool in a certain area (like Silicon Valley for tech)

Improved infrastructure (roads, ports) reducing shipping costs

Benefits of Achieving Economy of Scale

✔️ Lower Costs

✔️ Higher Profit Margins

✔️ Competitive Pricing Power

✔️ Ability to Reinvest in Growth

✔️ Stronger Negotiating Position with Suppliers

Risks of Growing Too Big: Diseconomies of Scale

However, growth isn't always good if not managed well.

Diseconomies of Scale happen when companies get too big, leading to:

Management inefficiencies

Communication breakdowns

Loss of motivation among employees

Slower decision-making

This can actually increase the average cost per unit, wiping out the advantages of growth.

🔍 Where You See Economy of Scale in Action

Manufacturing: Car companies like Toyota produce millions of vehicles to lower costs.

Technology: Tech giants like Amazon and Google operate at scale to deliver services worldwide at minimal marginal costs.

Retail: Walmart leverages bulk purchasing power to offer low prices.

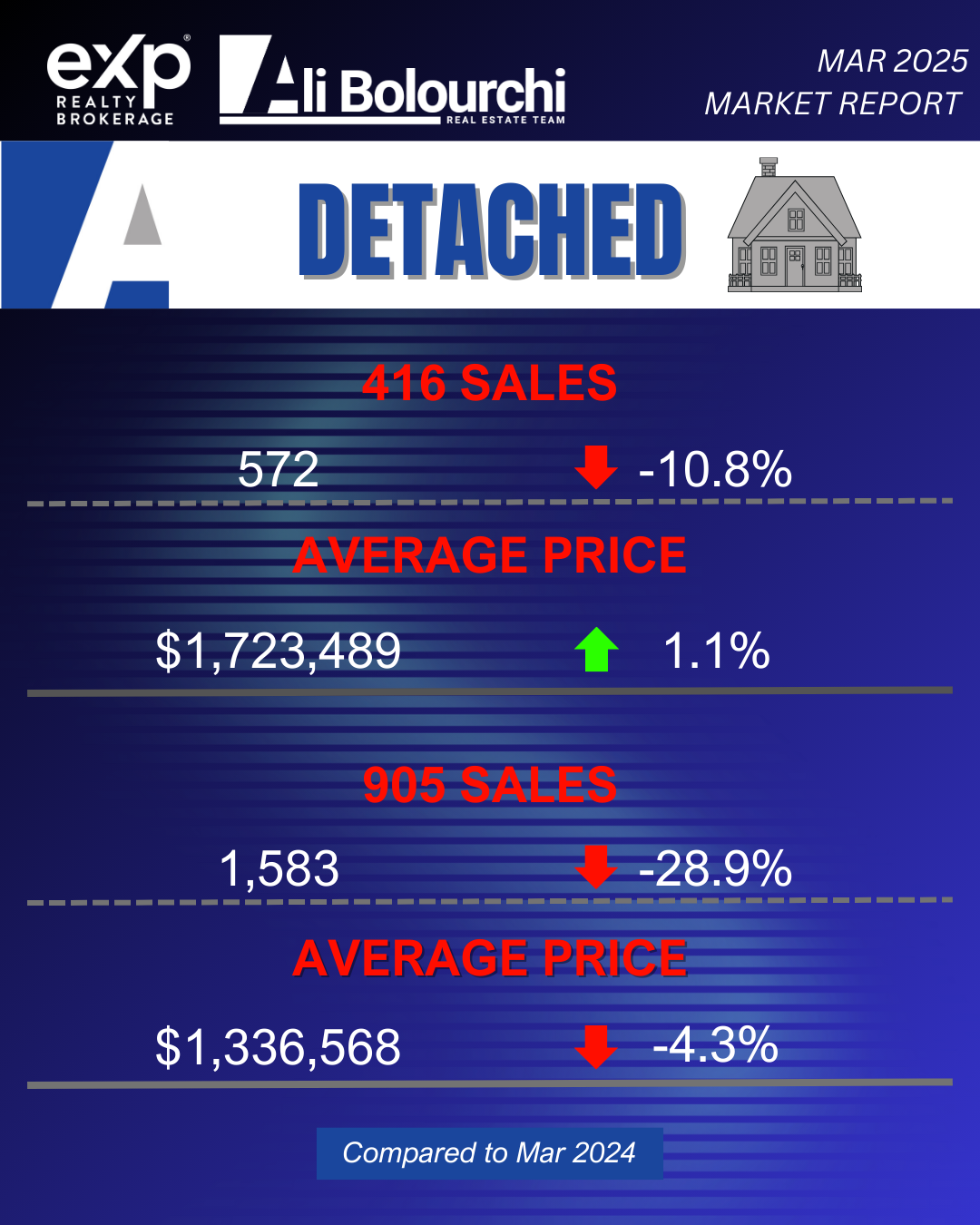

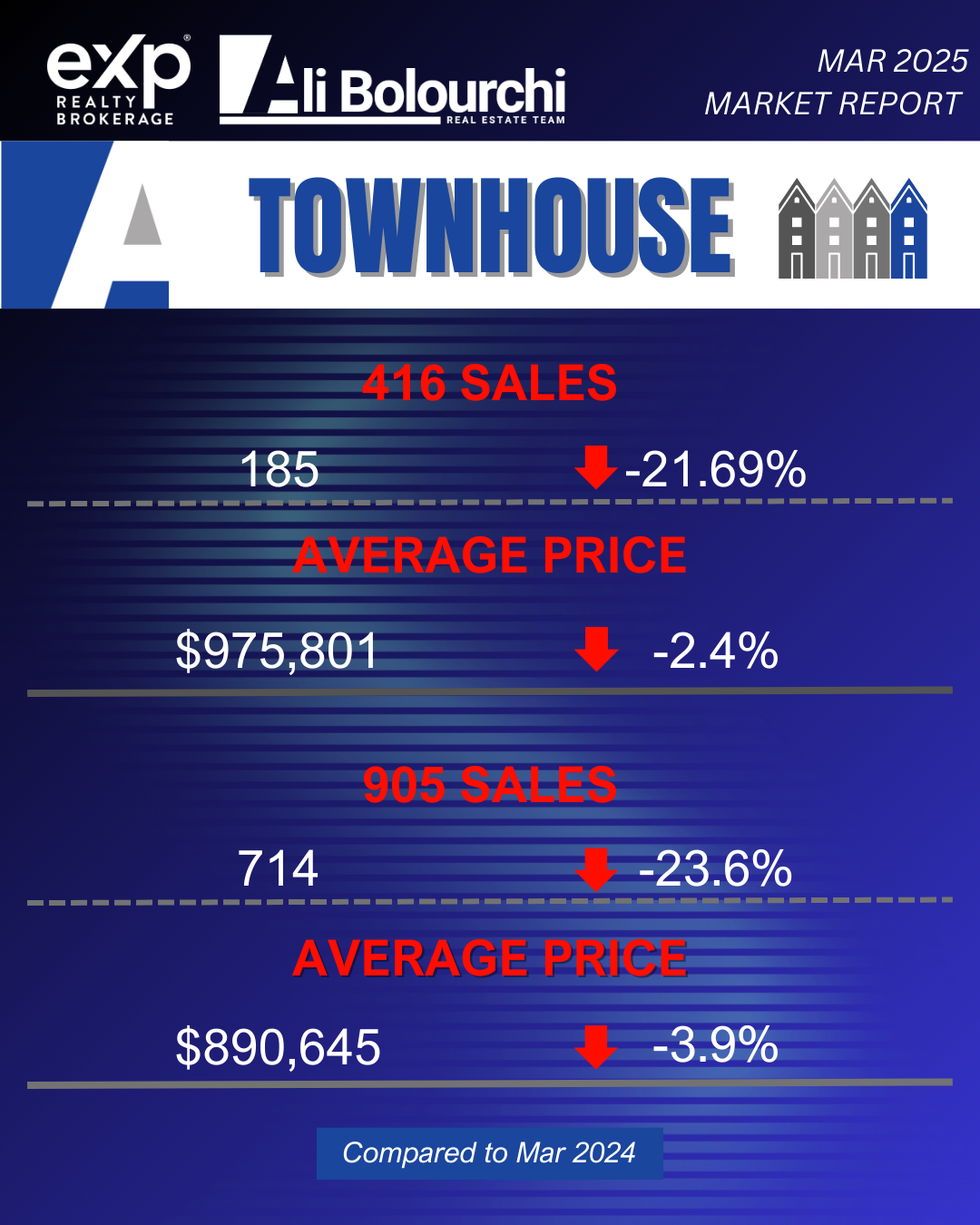

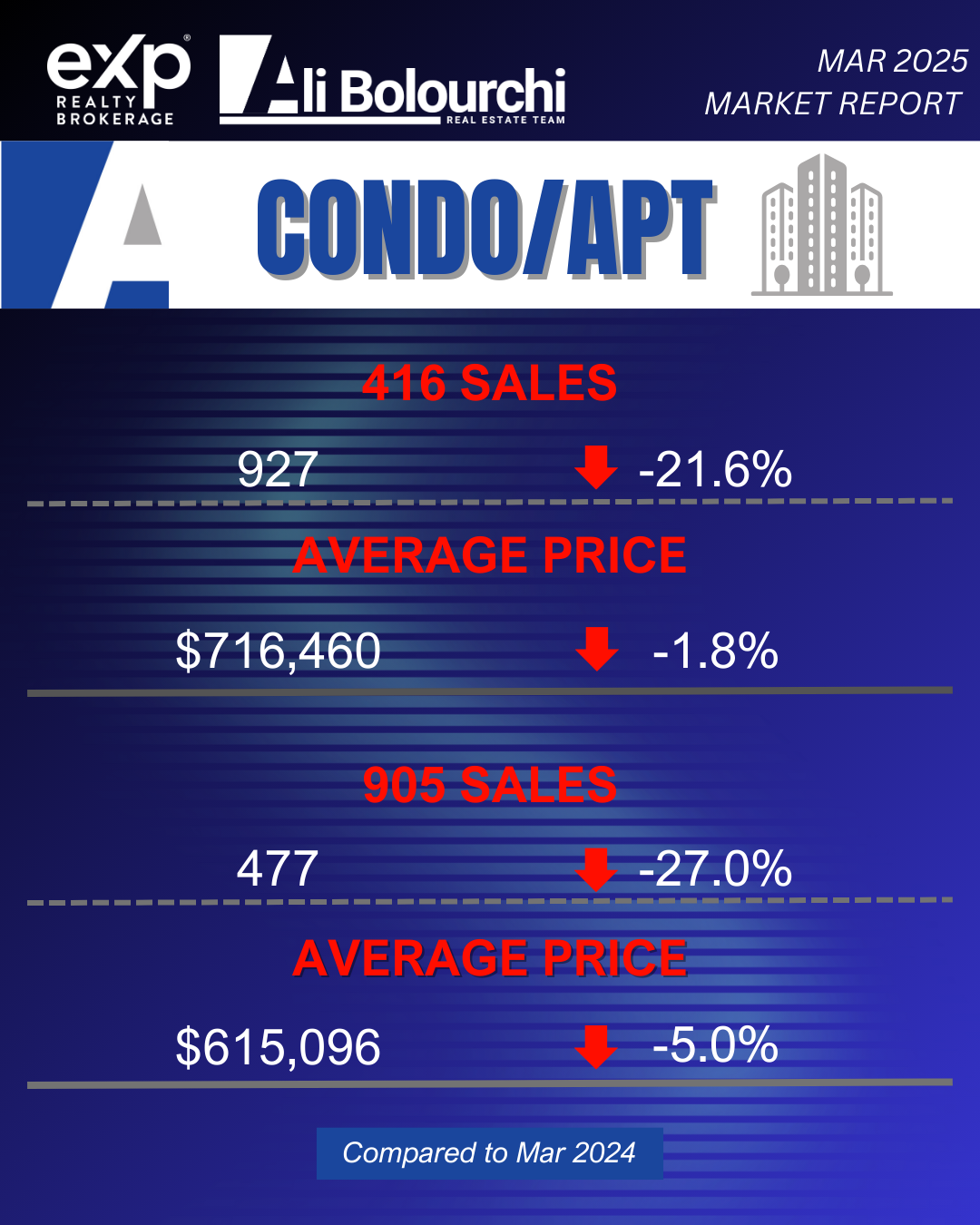

Real Estate: Large developers build entire communities to spread out land and construction costs.

Healthcare: Hospital networks negotiate lower rates for equipment and supplies.

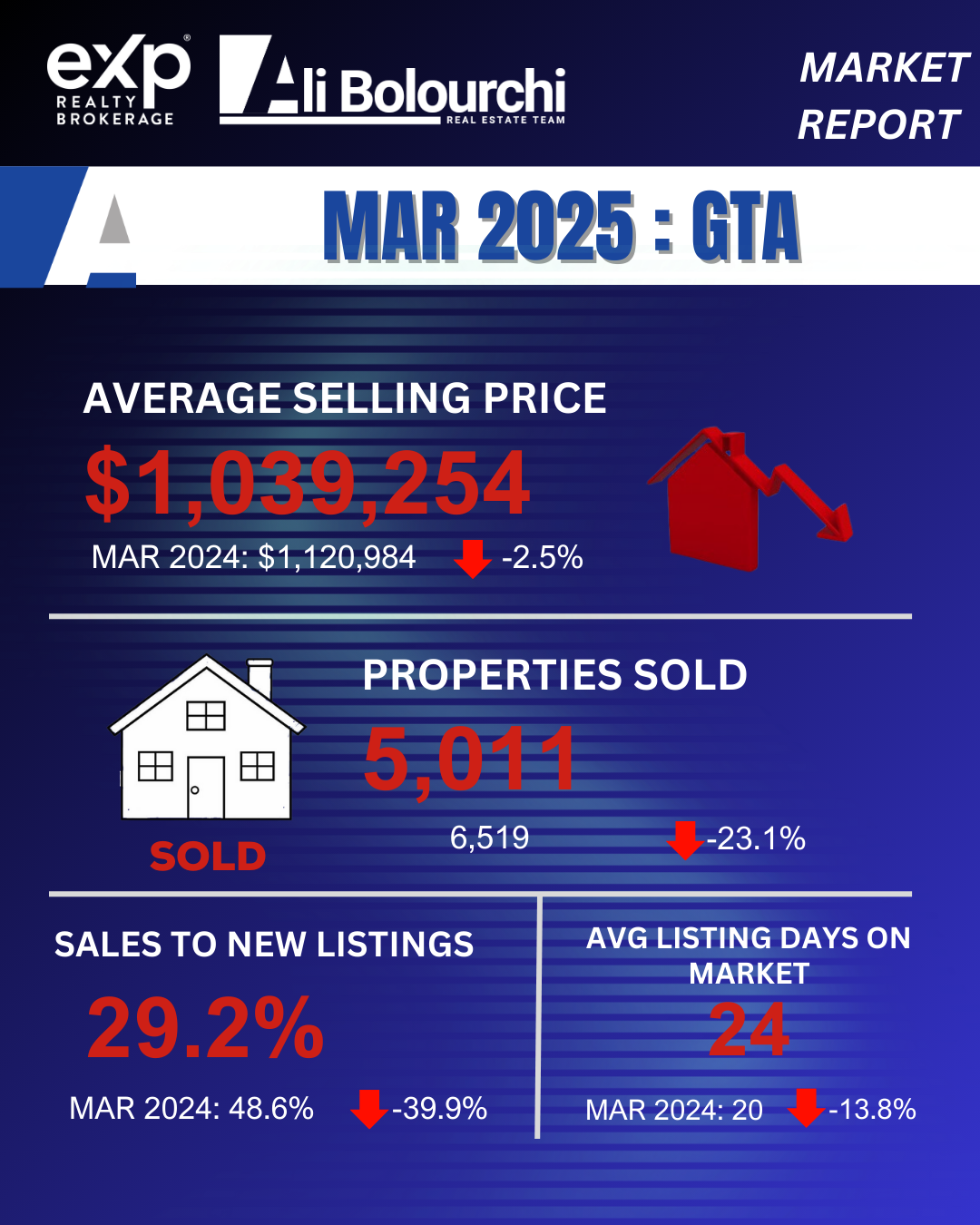

What Is the Economy of Scale in Real Estate Investing?

At its essence, economy of scale means that as the size of your operations grows, your cost per unit decreases, and your profit margins increase. This principle, borrowed from the world of manufacturing, is a powerful tool in the hands of savvy real estate investors.

📈 Chart: Cost Per Unit vs. Number of Units

Insight: As your portfolio grows, the fixed costs (maintenance, management, insurance) are spread across more units, reducing average costs.

Types of Investors Who Benefit Most from Scale

1. Multi-Family Investors

Manage one building with 10 tenants, instead of 10 properties scattered across the city.

2. Portfolio Investors

Own 10+ single-family homes? Group them for unified maintenance and streamline property management.

3. Pre-Construction Buyers

Buy multiple units in one project to take advantage of builder incentives and priority pricing.

Infographic: 5 Key Areas Where You Gain with Scale

1. Property Management

Lower fees for bulk management contracts.

2. Maintenance & Repairs

Volume-based discounts with contractors.

3. Insurance

Portfolio coverage policies are cheaper per property.

4. Marketing & Leasing

Lower cost per lead when promoting multiple units at once.

5. Financing

Better terms for experienced investors and bulk purchases.

Case Study: Scaling from 2 to 12 Units in 24 Months

A Toronto-based investor, started with a duplex in Scarborough. Over two years and with the right guidance, they scaled to 12 units across 3 properties in Newmarket and Barrie. Here’s what changed:

Property management cost dropped 32% per unit

Insurance cost reduced by 40% through portfolio consolidation

Net cash flow increased by 47%

🎯 Lesson learned? Scaling smartly increases both returns and efficiency.

Chart: Risk Diversification vs. Scale

Insight: You reduce risk by having multiple income streams but operational complexity rises, which means systems and teams become vital.

Ali’s Tip for Scalable Investment: Go Pre-Construction

Pre-construction is one of the most scalable investment paths in the GTA. Here's why:

Lower upfront capital

Appreciation before occupancy

Flexibility to assign or lease

Builder incentives for buying multiple units

Working with a broker who has early VIP access and understands investor math (like Ali Bolourchi) can put you years ahead.

✅ Summary: The Investor’s Roadmap to Scaling Smartly

✔️ Start with strong cash-flowing assets

✔️ Reinforce your systems: property management, accounting, tenant screening

✔️ Diversify across markets (Toronto, Barrie, Waterloo, Milton, etc.)

✔️ Scale up—don’t step up randomly

💼 Ready to Scale? Let’s Talk Strategy.

Whether you're at 2 doors or 20, there's a right way to scale and it starts with expert guidance.

%20Trans.png)