Introduction

Investing near transit isn’t just about convenience; it’s about strategic growth. Properties within a 10-minute walk of a subway or LRT stop have a history of commanding significant premiums, attracting long-term tenants, and outperforming the broader market. As the Greater Toronto Area (GTA) accelerates both its transit expansion and housing approval processes, understanding where the biggest upside lies is key for savvy investors.

The Big Picture: Policy & Scale

The Ontario government has introduced aggressive policies to combat the housing crisis by tying development directly to transit infrastructure. The plan is to create 1.5 million new homes over the next decade, with a specific focus on developing higher-density communities around 120 major transit station areas. This "Transit-Oriented Communities" initiative aims to:

Unlock Vast Swaths of Land: By simplifying zoning and approving higher-density permissions, the plan opens up previously low-rise or under-utilized land for multi-unit projects.

Fast-Track Approvals: With shortened timelines and a focus on ministerial zoning orders (MZOs), the approval process for new projects is being streamlined. This allows builders to start construction faster and, crucially, allows early investors to capture price appreciation before mass construction begins.

Key Projects to Watch

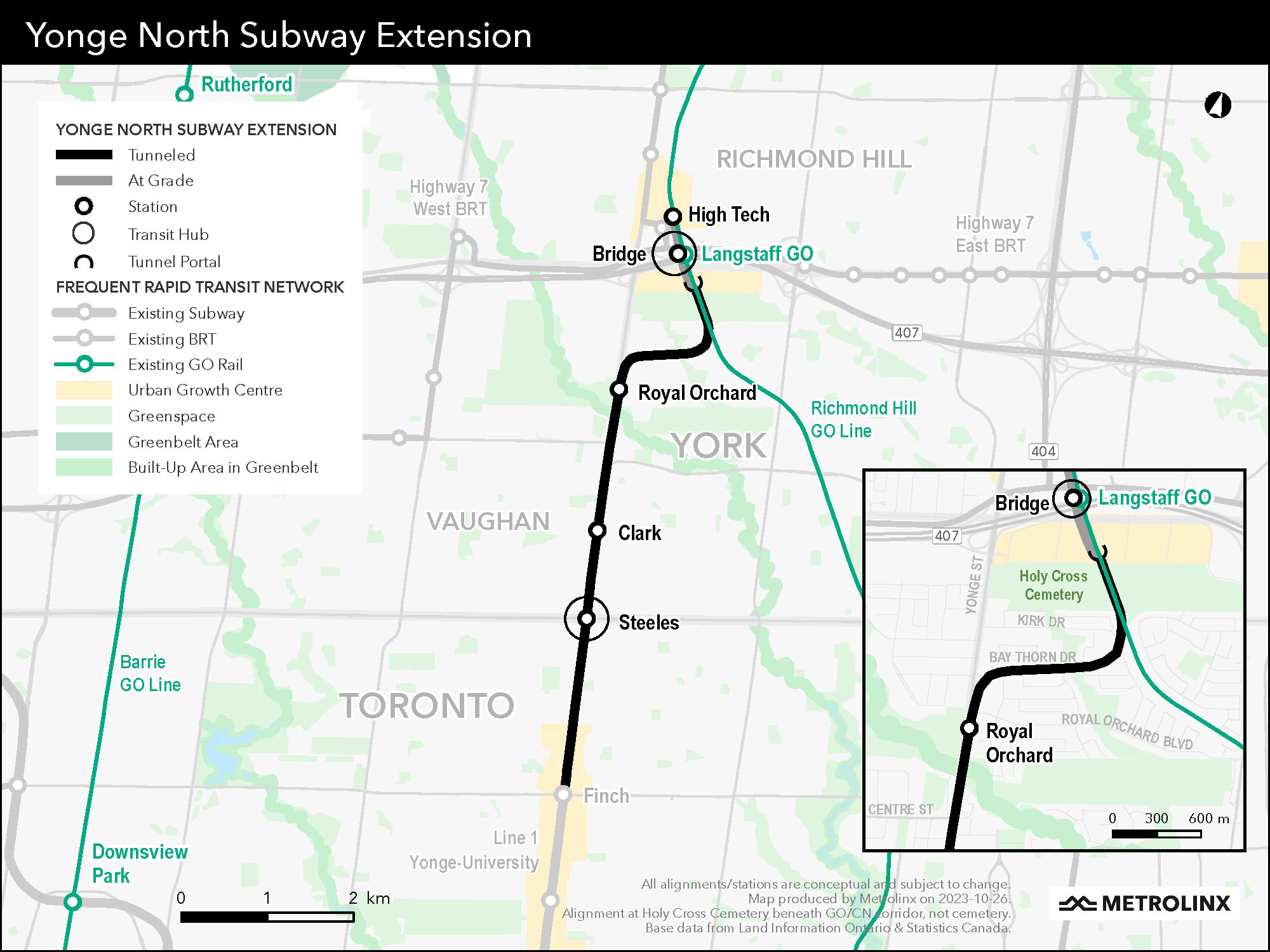

While several projects are underway, here is a look at three major extensions poised to redefine their respective communities.

Data Source: Metrolinx & TTC public records. The Eglinton East LRT is a City of Toronto-led project that still requires full funding for construction to proceed beyond the design phase. The Finch West LRT is in its final stages of testing and commissioning.

Data Source: Metrolinx & TTC public records.

Emerging Hotspots for Early Investors

The most significant gains are often found in areas that are not yet established, but where new transit is a confirmed catalyst. Here are some key areas to watch:

North York (Steeles West Station): While the Finch West LRT is expected to be operational in late 2025, the area surrounding the new Steeles West Station remains a hotspot for early investors. Similar projects have shown historic price growth in the 8%–12% range. New mid-rise condo projects here offer a significant price advantage over comparable downtown units.

Richmond Hill Centre: As the Yonge North Subway Extension takes shape, Richmond Hill Centre is positioned as the new "urban growth centre" for the region, with planned office and retail space. The market is already responding, and an investment here is a bet on the long-term vision of a new downtown core.

Markham–Unionville: The Yonge North extension will connect Markham directly to the subway system, a first for the city. This provides an instant link to major tech and corporate campuses. With strong demand, upcoming mixed-use nodes are projected to offer strong rental yields, making them attractive to both investors and end-users.

Vaughan Metropolitan Centre (VMC): As an already established transit hub, VMC provides a powerful case study. Since the subway extension opened in 2017, average resale condo prices have seen substantial appreciation, underscoring the long-term impact of new transit. With further intensification planned, the momentum is expected to continue.

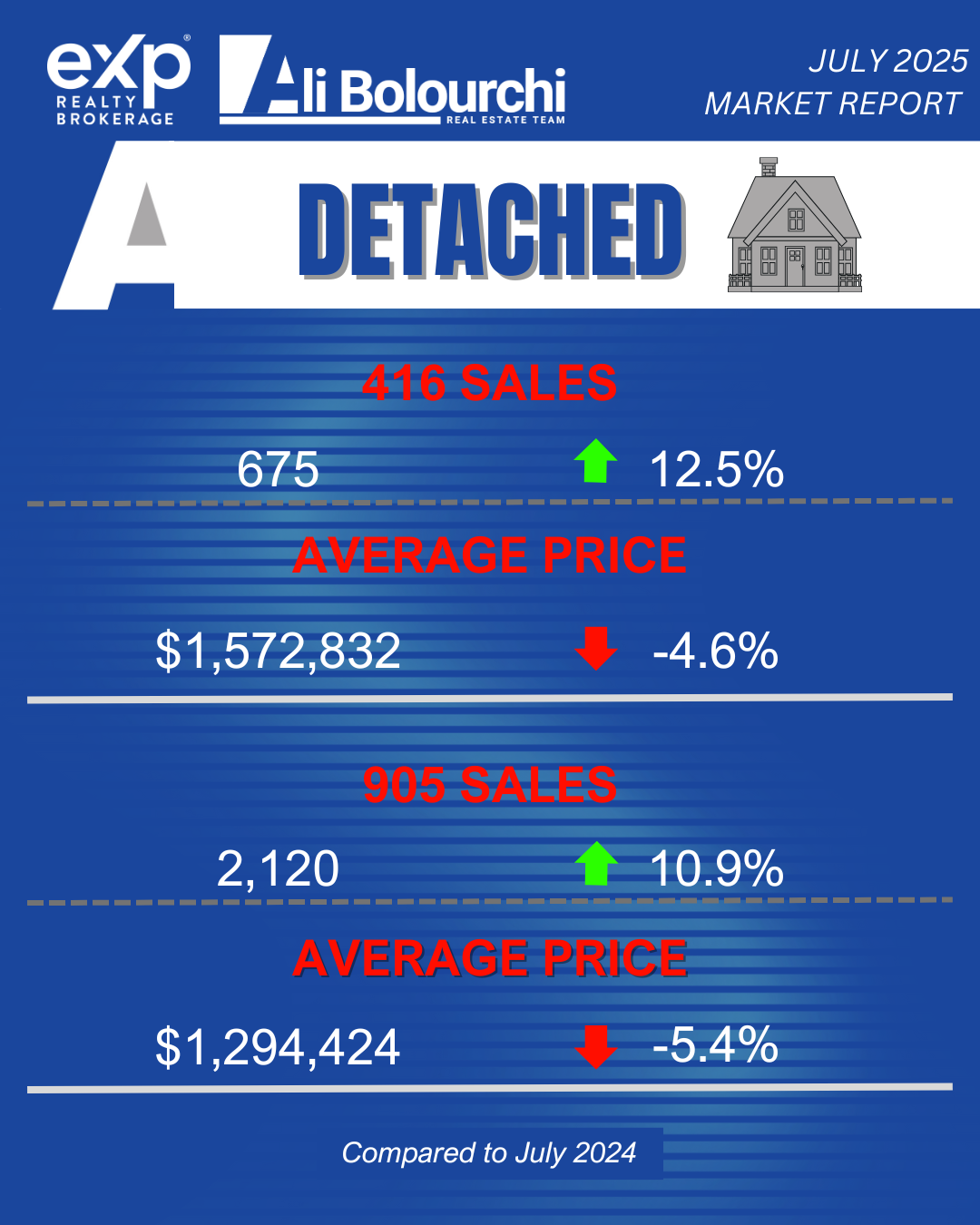

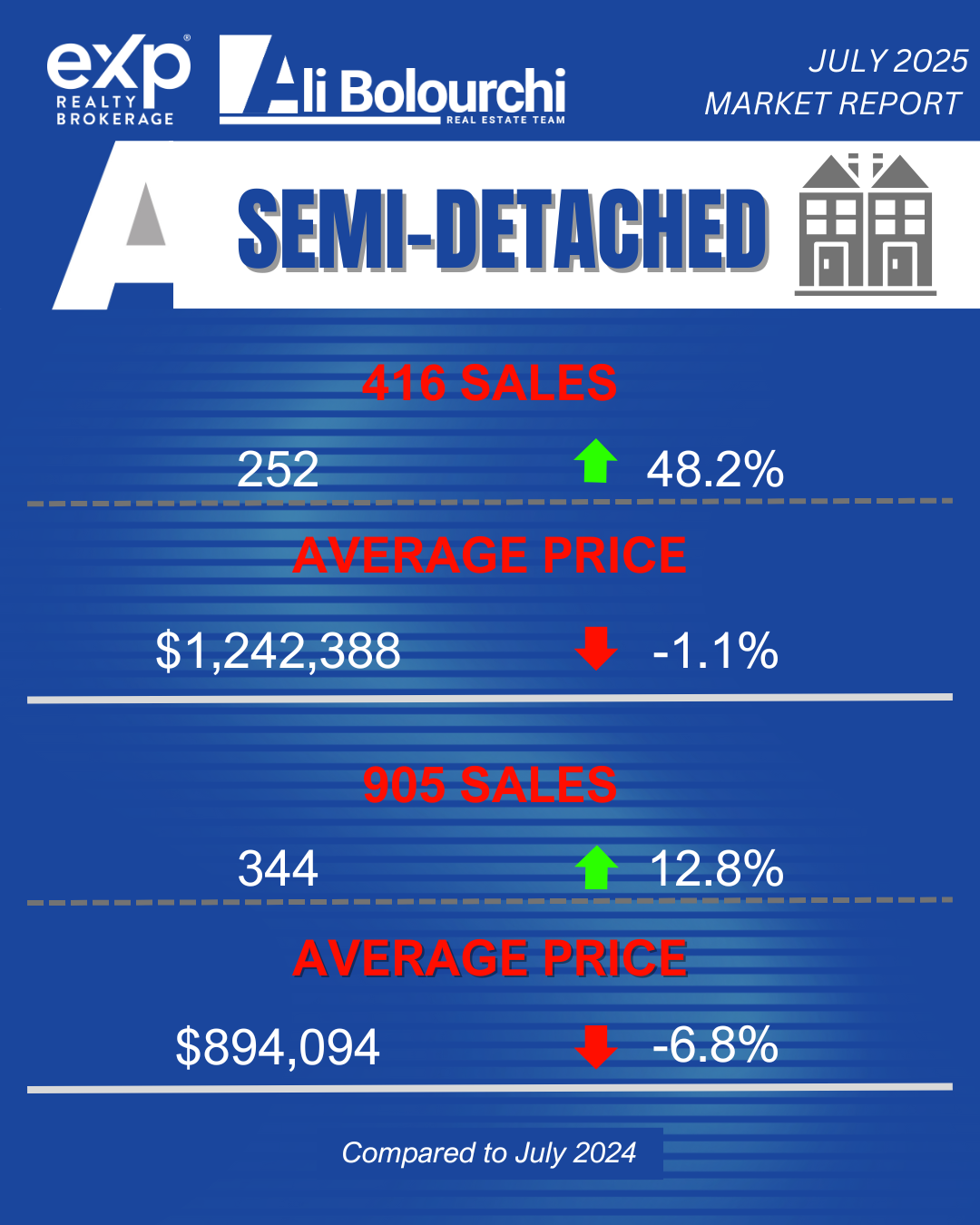

Pricing & Demand Dynamics

The impact of transit is quantifiable. A 2022 study by the C.D. Howe Institute found that properties within 500 meters of a new transit stop could see a value premium of up to 10-25% over properties further away.

For pre-construction, the opportunity is even more pronounced. Early-stage pricing for VIP access to pre-construction projects often offers a significant discount compared to final market value. By securing a deposit on these units, investors can lock in strong equity gains before the building is completed and fully integrated into the transit network.

Properties within 500 m of transit: Historical premiums of 10%–25%.

Early pre-construction pricing: Typically sits 20%–30% below end-value.

Actionable Investment Strategies

Secure Pre-Launch Units: Leverage relationships with brokers who have access to "Platinum" and "VIP" sales events to get the best pricing and selection before a project is launched to the general public.

Conduct Due Diligence: Go beyond the glossy brochures. Audit final station alignment maps, check shadowing studies, and confirm local zoning changes to ensure the project aligns with your long-term vision.

Plan Your Exit: The best returns are often realized in the 3- to 5-year hold period, as the project nears completion and the full benefit of transit service becomes apparent to the market.

Diversify Your Asset Mix: Consider combining low-rise townhomes for steady cash flow with pre-construction condos for rapid price appreciation.

Next Steps

The GTA is undergoing a fundamental shift in its urban planning, and transit-oriented development is at the heart of this change. This is a chance to invest not just in real estate, but in the future of our communities.

To learn more, which section would you like us to explore in greater detail?

Detailed neighborhood profiles with real-life comparables

A deep dive on zoning changes and fast-track approvals

Sample financial models illustrating hold periods and ROI