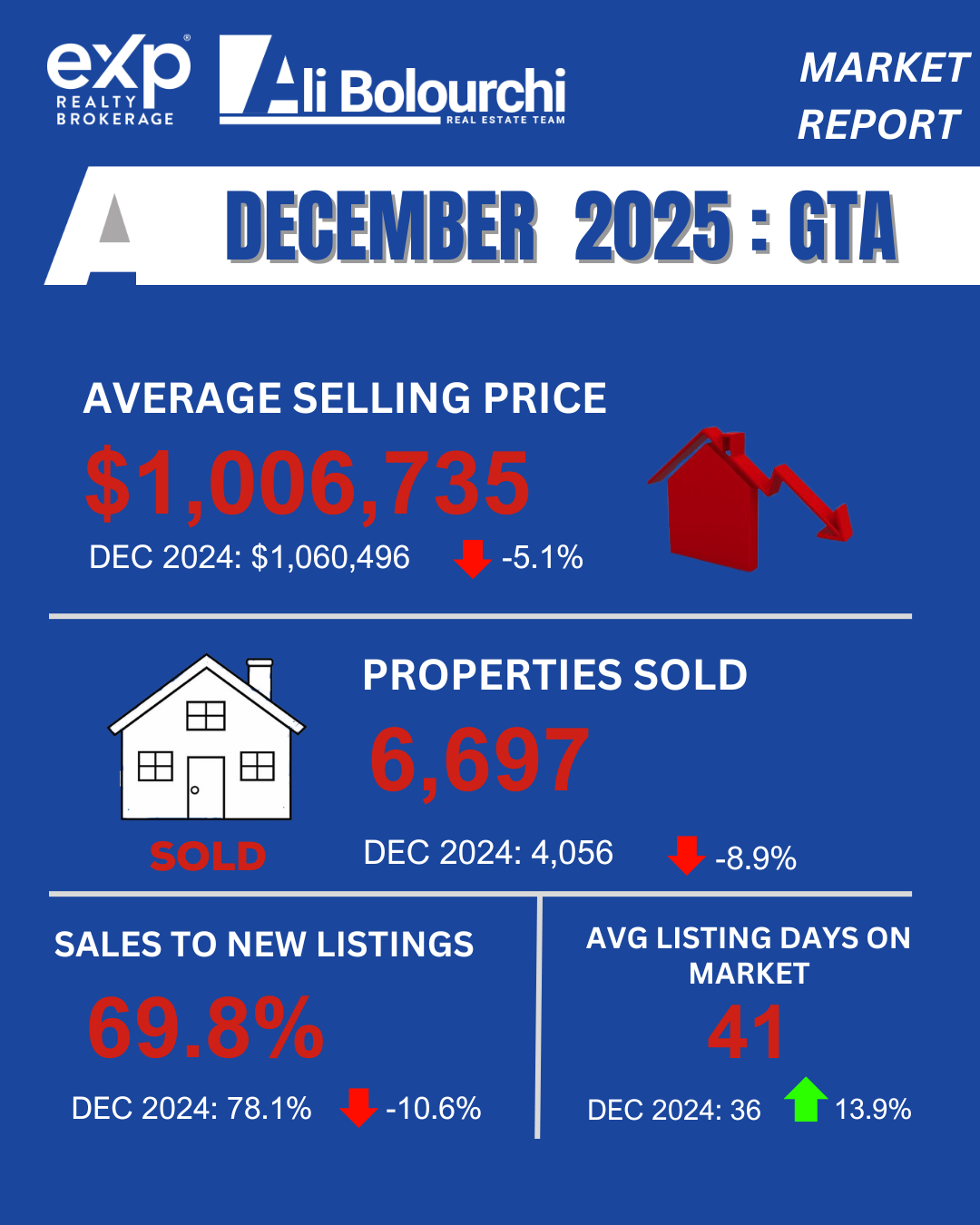

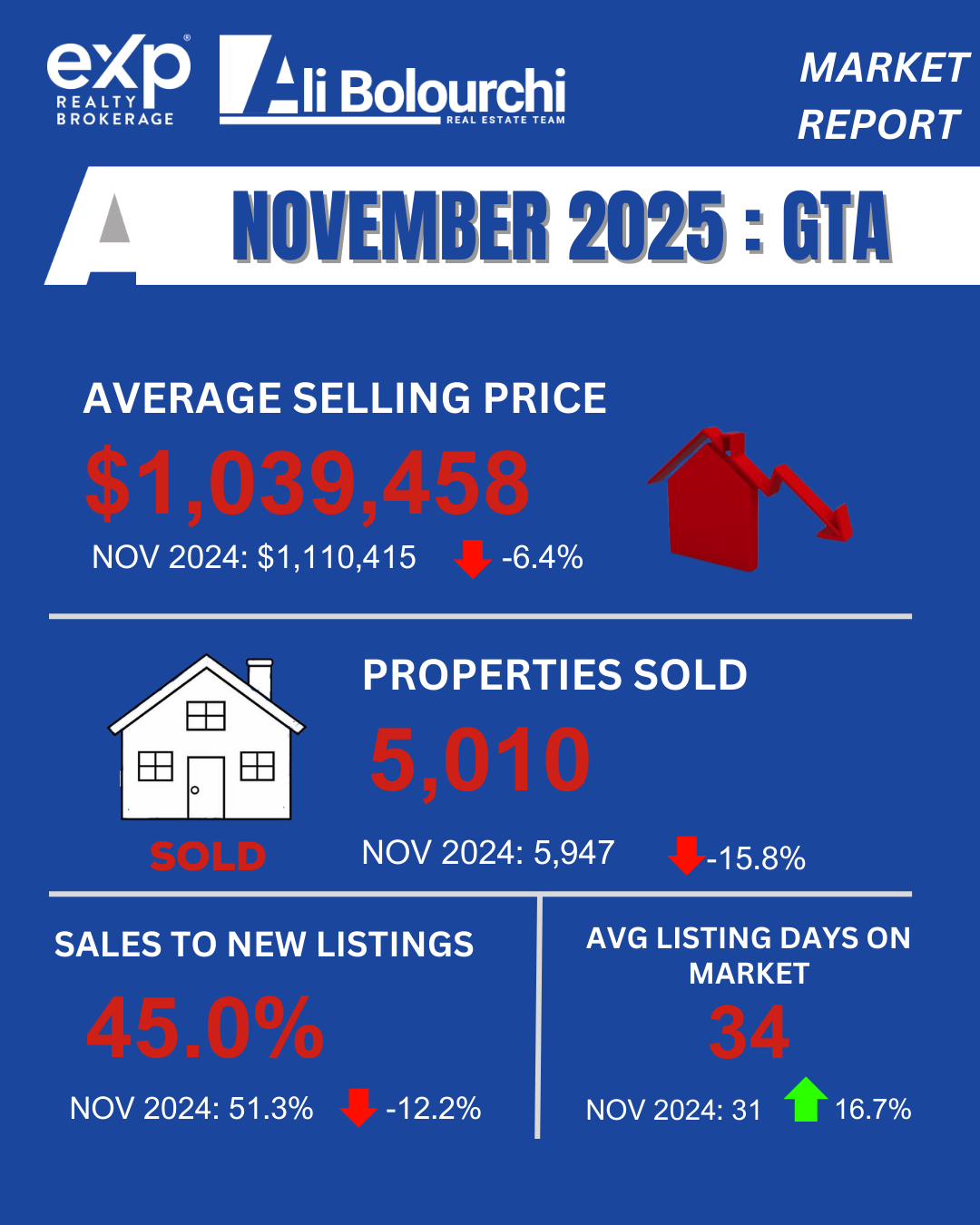

The Greater Toronto Area (GTA) housing market closed out 2025 with a clear message: affordability is improving, and the stage is being set for recovery. As economic uncertainty and elevated inventory levels weighed on consumer confidence throughout the year, we saw a cooling in sales volume and a downward negotiation on selling prices.

For buyers, this "challenging market" has created a unique window of opportunity. With the average selling price across the GTA dipping to $1,006,735 in December (down 5.1% year-over-year), improved affordability is finally becoming a reality. As TRREB President Daniel Steinfeld noted, once confidence in the economy and labour market solidifies, we expect pent-up demand to drive sales back up.

Here is a deep dive into how the 416 (City of Toronto) and 905 (Suburban GTA) markets performed by property type in December 2025.

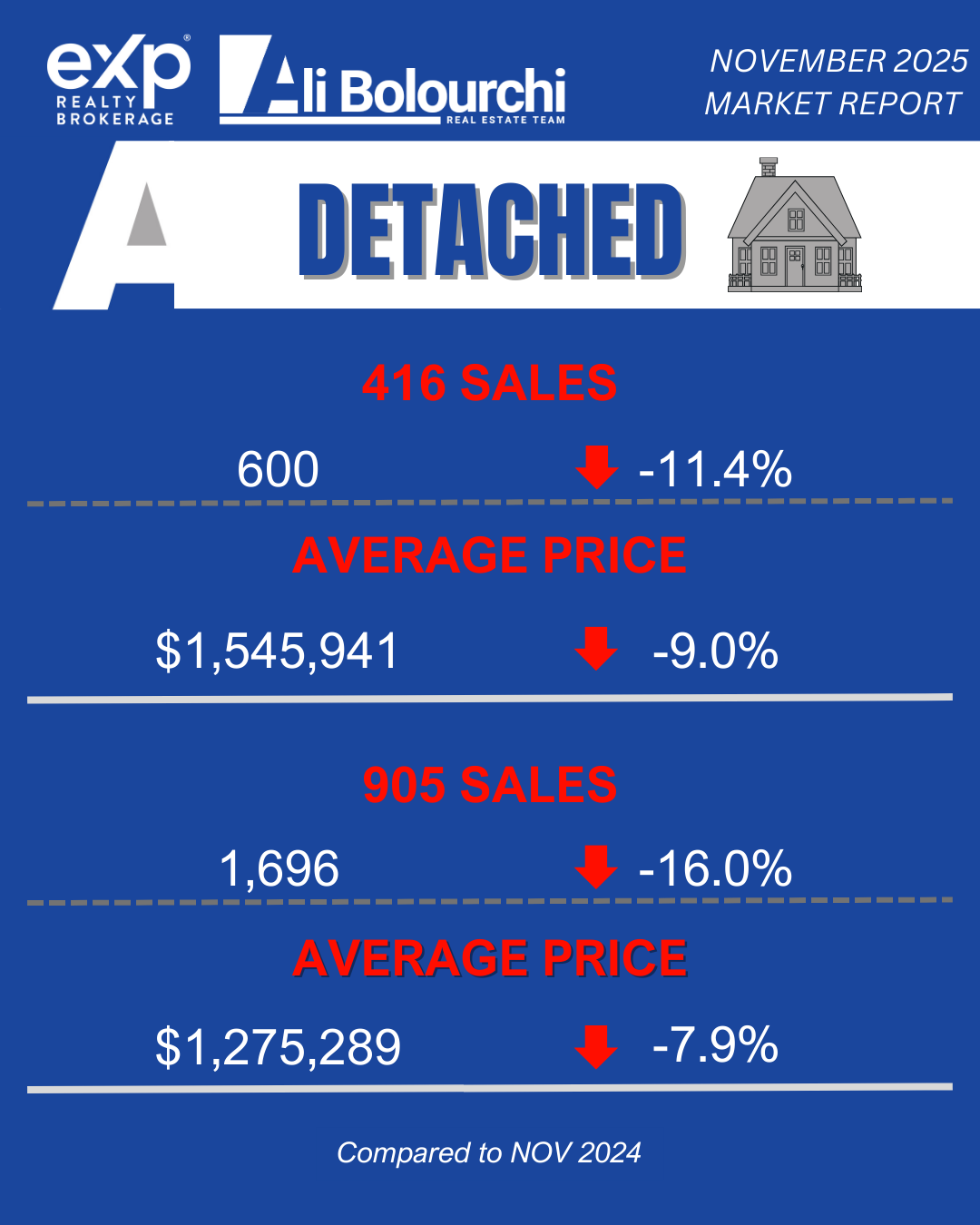

🏡 Detached Homes

The detached market remains the premium segment, but buyers are finding significantly more room to negotiate than in previous years. Both the 416 and 905 regions saw price corrections, offering relief to families looking for more space.

416 (Toronto Core)

Sales: 413 transactions.

Average Price: $1,498,079.

Trend: Prices in the city dropped by 4.5% year-over-year. While still the most expensive segment, this dip brings the entry point for city detached living slightly lower.

905 (GTA Suburbs)

Sales: 1,277 transactions.

Average Price: $1,239,882.

Trend: The suburbs saw a steeper decline, with prices down 7.0% compared to last December. This suggests that the "exodus to the suburbs" premium has cooled, restoring better value for money in the 905.

Insight: If you are a move-up buyer, the gap between selling a smaller home and buying a detached property has narrowed, particularly in the 905 region.

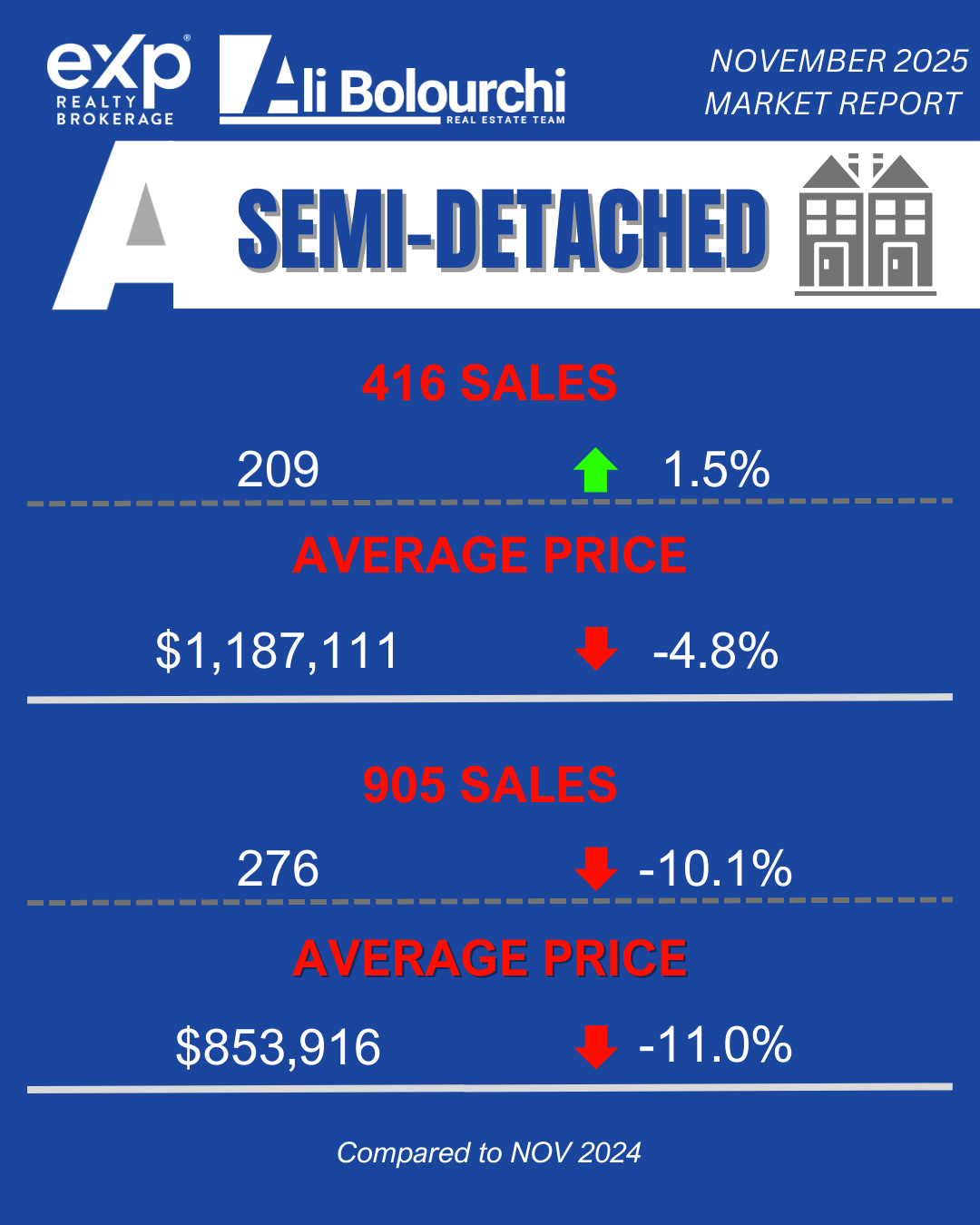

🏘️ Semi-Detached Homes

Semi-detached homes often serve as the bridge between condos and detached living. In December 2025, this segment experienced the most significant price adjustments, particularly in the 416.

416 (Toronto Core)

Sales: 122 transactions.

Average Price: $1,122,309.

Trend: A sharp year-over-year price decline of 12.2%. This correction makes semi-detached homes in the city one of the most attractive value propositions for buyers right now.

905 (GTA Suburbs)

Sales: 201 transactions.

Average Price: $857,237.

Trend: Prices dropped by 9.9%. With an average price well under the $1M mark, 905 semis are a prime target for first-time buyers stretching their budgets.

Insight: The double-digit drop in the 416 suggests sellers must be incredibly sharp with pricing. Buyers in this segment are price-sensitive and willing to wait for the right deal.

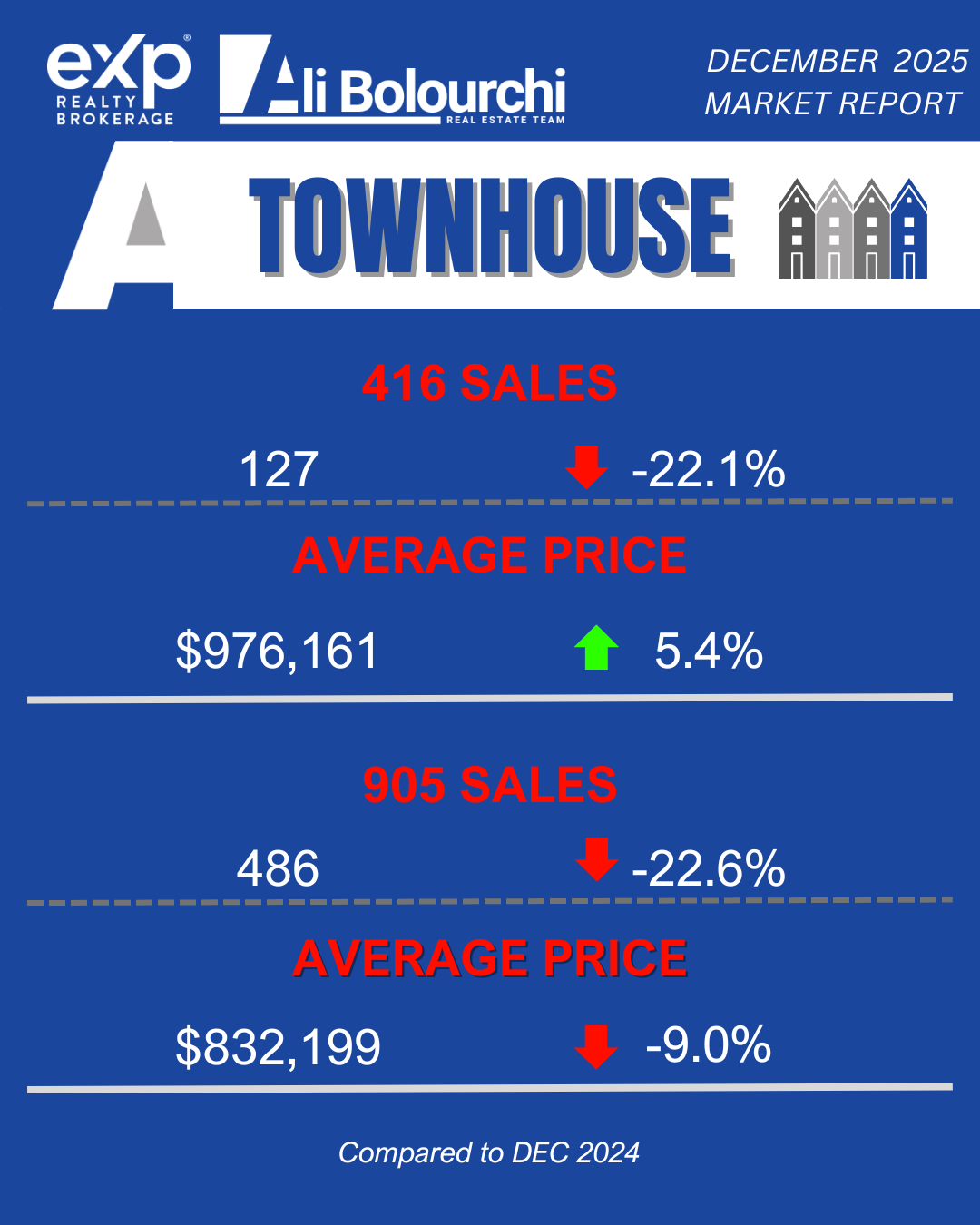

🏙️ Townhouses

Townhouses presented a tale of two markets in December. While the suburbs followed the general cooling trend, the City of Toronto townhouse market showed unexpected resilience.

416 (Toronto Core)

Sales: 127 transactions.

Average Price: $976,161.

Trend: Surprisingly, this was the only segment to show growth, with prices up 5.4% year-over-year. This indicates strong demand for freehold alternatives within the city limits.

905 (GTA Suburbs)

Sales: 486 transactions.

Average Price: $832,199.

Trend: In contrast, the 905 saw prices decline by 9.0%. The significant price gap between a 416 and 905 townhouse (approx. $144k) is likely driving some buyers to look further afield for value.

Insight: The strength of the 416 townhouse market suggests that buyers who are priced out of detached homes are aggressively competing for these units, keeping prices buoyant.

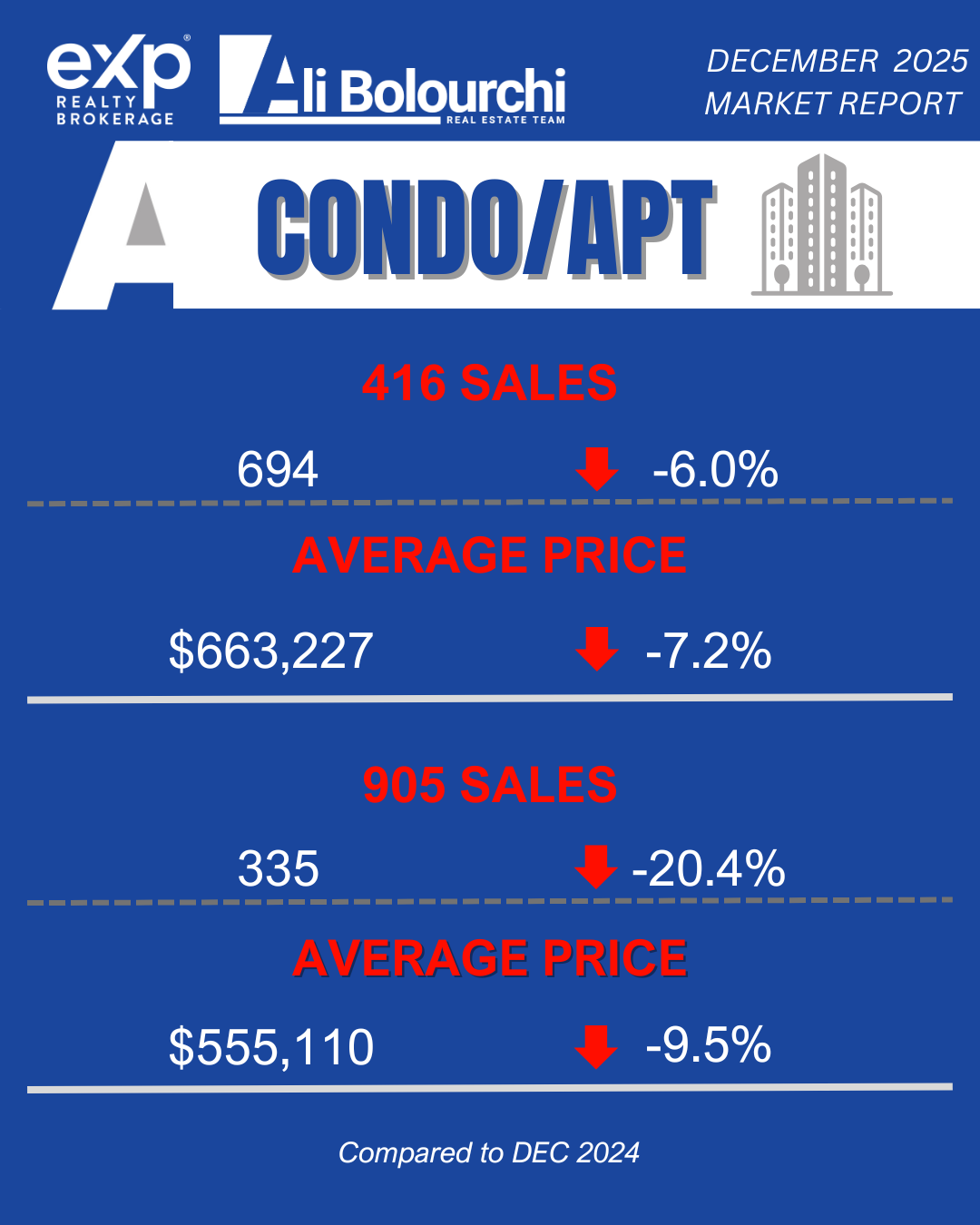

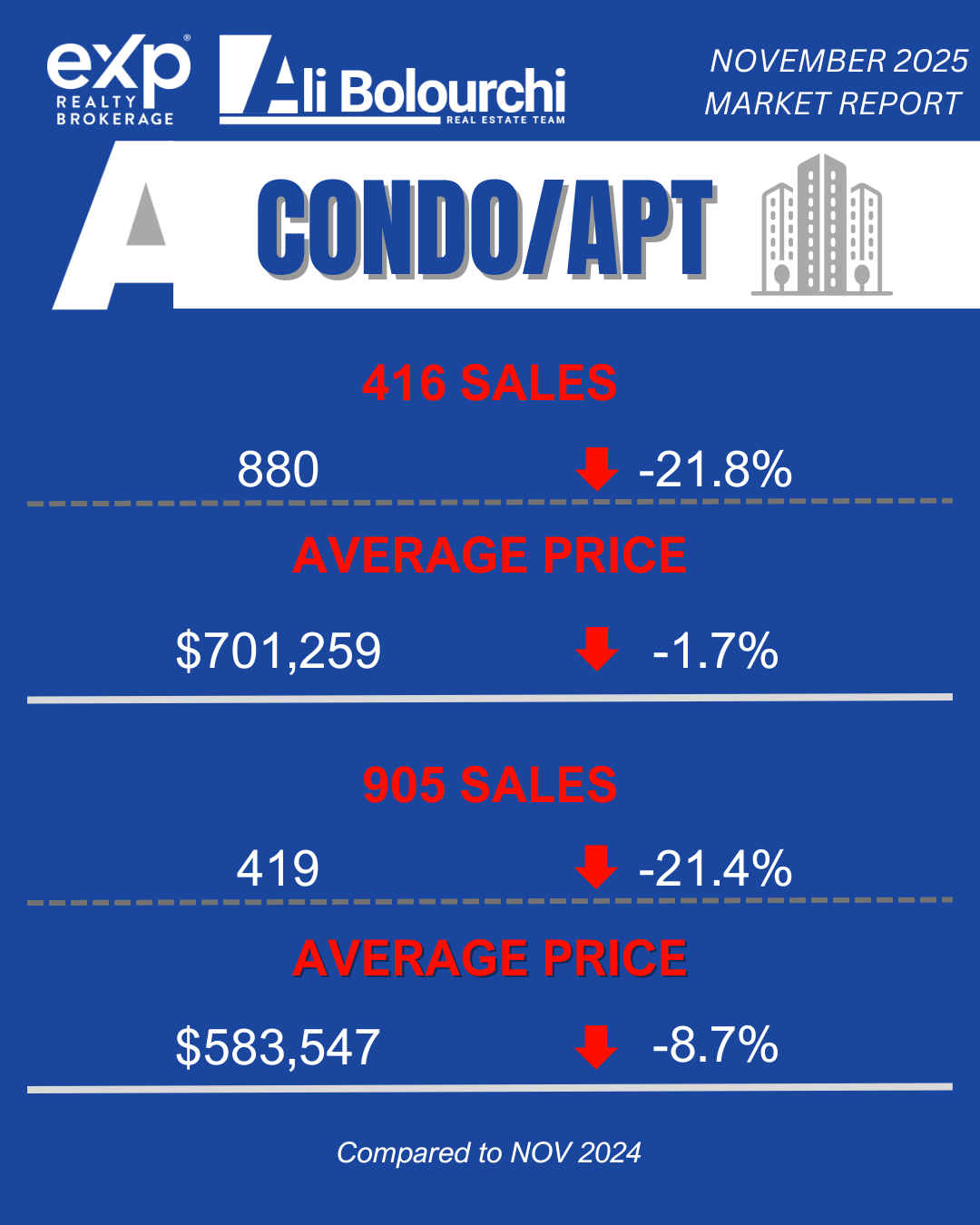

🏢 Condo Apartments

The condo market continues to face headwinds with elevated inventory levels, allowing for selling prices to be negotiated downward. This sector remains the most affordable entry point into homeownership.

416 (Toronto Core)

Sales: 694 transactions.

Average Price: $663,227.

Trend: Prices are down 7.2% year-over-year. With the average price sitting in the mid-$600s, affordability for singles and young professionals has improved noticeably.

905 (GTA Suburbs)

Sales: 335 transactions.

Average Price: $555,110.

Trend: The suburban condo market softened further, with a 9.5% price drop. This brings the average price dangerously close to the $550k mark, offering exceptional value for investors or first-time buyers.

Insight: With listing inventory remaining elevated, condo buyers have the luxury of choice and time. Sellers must focus on presentation and strategic pricing to stand out in a crowded market.

Final Thoughts & Recommendation

The December 2025 statistics paint a picture of a market in transition. While sales are down 11.2% overall for the year , the "improved affordability" narrative is the silver lining that will likely spark the recovery.

For Buyers: The current climate allows you to negotiate selling prices downward. You have the leverage today that you may not have tomorrow once economic confidence returns.

For Sellers: The days of "listing and waiting for a bidding war" are paused. With inventory up and prices adjusting, you must price ahead of the market, not chase it down. As Jason Mercer, TRREB Chief Information Officer, noted, households need to be confident in their employment before committing, meaning your property needs to scream "value" and "security" to attract serious offers.

Want a personalized pricing strategy for your property?

Let’s chat and position your home ahead of the market—not behind it.

%20Trans.png)