February 2025 was a mixed bag for the Greater Toronto Area (GTA) real estate market. While home buyers enjoyed ample choices with high inventory levels, sales numbers dipped compared to last year, reflecting ongoing affordability challenges and economic uncertainty.

Market Highlights

Sales: 4,037 homes sold, marking a 27.4% decline from February 2024.

Listings: 12,066 new listings, a 5.4% increase year-over-year.

Average Price: $1,084,547, representing a 2.2% decrease from last year.

MLS® HPI Composite Benchmark: Down 1.8% year-over-year.

Detached Home Sales: A Closer Look

416 Region (Toronto)

Sales: 411 detached homes sold (down 27.1% year-over-year).

Average Price: $1,782,262 (up 7.6% year-over-year).

905 Region (GTA suburbs)

Sales: 1,295 detached homes sold (down 32.3% year-over-year).

Average Price: $1,339,120 (down 3.0% year-over-year).

Semi-Detached Home Sales

416 Region (Toronto)

Sales: 145 semi-detached homes sold (down 19.4% year-over-year).

Average Price: $1,275,214 (down 3.5% year-over-year).

905 Region (GTA suburbs)

Sales: 211 semi-detached homes sold (down 24.1% year-over-year).

Average Price: $945,841 (down 5.3% year-over-year).

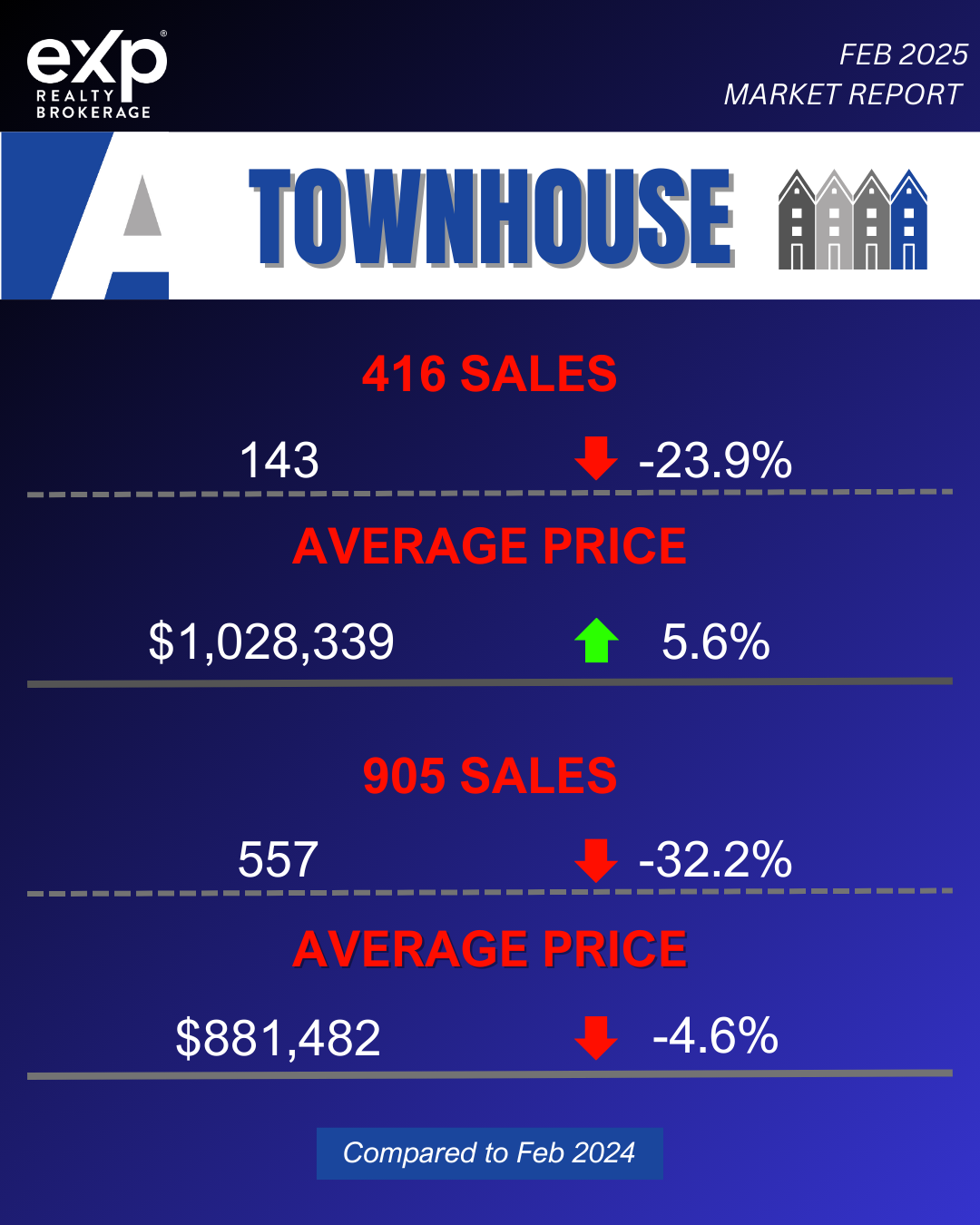

Townhouse Sales

416 Region (Toronto)

Sales: 143 townhouses sold (down 23.9% year-over-year).

Average Price: $1,028,339 (up 5.6% year-over-year).

905 Region (GTA suburbs)

Sales: 557 townhouses sold (down 32.2% year-over-year).

Average Price: $881,482 (down 4.6% year-over-year).

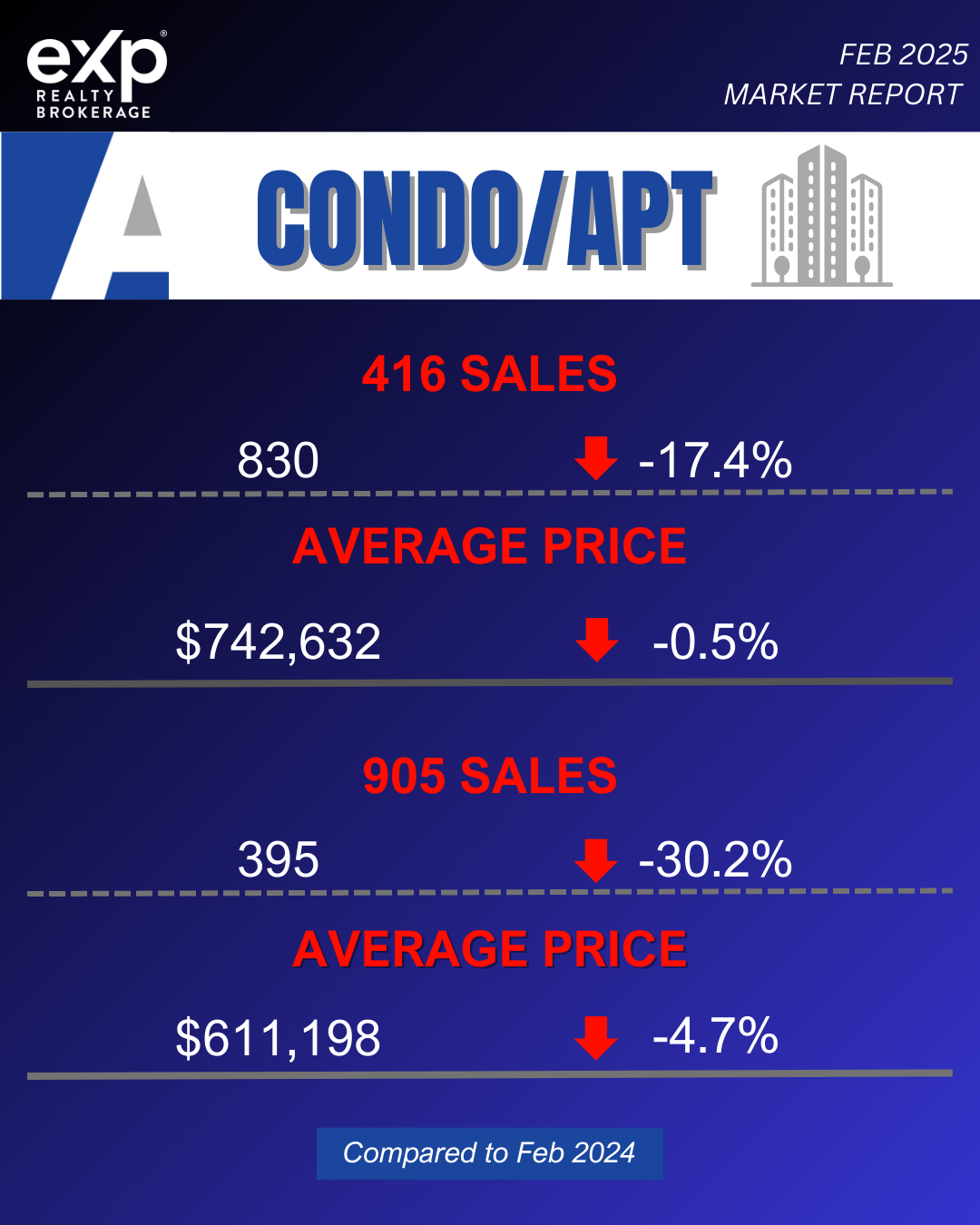

Condo/Apartment Sales

416 Region (Toronto)

Sales: 830 condos sold (down 17.4% year-over-year).

Average Price: $742,632 (down 0.5% year-over-year).

905 Region (GTA suburbs)

Sales: 395 condos sold (down 30.2% year-over-year).

Average Price: $611,198 (down 4.7% year-over-year).

What’s Driving the Market?

Buyers currently hold strong negotiating power due to the high number of available listings. However, rising borrowing costs have made affordability a concern, keeping some potential buyers on the sidelines. Economic uncertainty, particularly regarding Canada’s trade relationship with the U.S., has also contributed to a more cautious approach from buyers.

Looking Ahead: What to Expect in 2025

Experts anticipate that borrowing costs may decrease in the coming months, which could help revive demand and improve affordability. If economic uncertainties ease and interest rates drop, the GTA housing market may see stronger activity in the second half of 2025.

The Role of Policy and Consumer Confidence

With the Ontario provincial election behind us and ongoing shifts in federal policies, there’s a pressing need for clarity on housing affordability, supply strategies, and broader economic policies. Clear government direction will play a significant role in restoring buyer confidence and shaping the trajectory of the real estate market.

Final Thoughts

For now, buyers can take advantage of the increased inventory and negotiate better deals, while sellers may need to adjust expectations in a cooling market. Detached home prices in Toronto have risen despite declining sales, while suburban prices have dipped. Semi-detached homes and condos have seen price declines across both 416 and 905 regions, while townhouses in Toronto have experienced an increase in average price. Keeping an eye on interest rate trends and economic policies will be key in determining the market’s direction for the rest of the year.