The moment we've all been waiting for is finally here! This morning, the Bank of Canada announced a 25 basis point reduction to its overnight rate, bringing it down to a new target of 2.5%. For many prospective homeowners in the Greater Toronto Area, this isn't just a news headline; it's the official signal that a new, more encouraging chapter is beginning in the real estate market. This is the first rate cut since March, and its timing is a deliberate move to stimulate an economy showing signs of weakness and to keep inflation in check.

This is a powerful development because it directly impacts the cost of borrowing and, by extension, your ability to get into the market. After a period of careful consideration, the Bank of Canada determined that with a softer economy and contained inflation, it was the right time to reduce rates to help balance the scales. The era of relentless rate hikes is officially over, and we are now in a phase where monetary policy is shifting to support economic activity.

What This Means for GTA Buyers: Your Opportunity Has Arrived

For many prospective homeowners in the GTA, this rate cut could be the catalyst you've been waiting for. It’s a direct boost to your buying power and can make the difference between a dream home being within reach or just a distant goal. Here’s a breakdown of the impact:

Increased Affordability: A lower interest rate means your mortgage payments will be smaller. Even a 0.25% drop can translate into significant savings over the life of a mortgage, making monthly payments more manageable and easing the financial burden of homeownership.

Boosted Buying Power: Lower rates mean you can qualify for a larger mortgage amount with the same income. This could open up new possibilities and allow you to consider a larger home or a more desirable neighbourhood that was previously out of your price range.

Renewed Market Momentum: This rate cut is a signal that the market is beginning to normalize. It’s likely to bring more buyers who have been sitting on the sidelines back into the market, increasing activity and confidence. This can lead to a more balanced and predictable market where both buyers and sellers have a clearer sense of value.

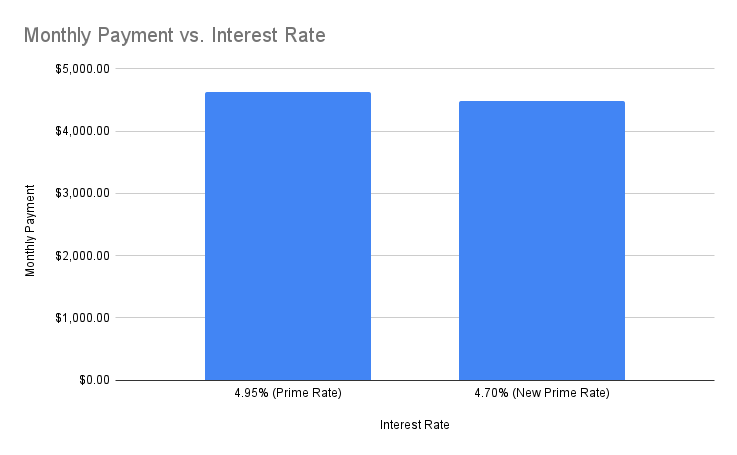

Comaprison

Mortgage Amount: $800,000

Amortization Period: 25 Years

Please note: The following calculations are based on the Prime Rate, which the Bank of Canada's overnight rate directly influences. The recent 25 basis point cut lowers the Prime Rate from 4.95% to 4.70%.

The Impact on GTA Sellers: A Growing Pool of Buyers

Sellers have every reason to be optimistic as well. An influx of newly qualified and motivated buyers into the market is a huge advantage. As affordability improves, the pool of potential buyers for your property expands. This increased demand can lead to more competition for desirable homes, which could result in stronger offers and potentially shorter listing times. A line graph showing the recent trend of active listings and sales volumes in the GTA, with a forward-looking prediction, would visually demonstrate this expected uptick in market activity.

Predictions for Investors and Landlords: A Strategic Play

For investors and landlords, this rate cut presents a strategic opportunity. Lower financing costs directly improve your cash flow and can make it more affordable to finance new investment properties or refinance existing ones. As market activity picks up, the potential for capital appreciation on well-located properties also increases, offering a dual benefit of improved cash flow and long-term equity growth.

Conclusion: Seize the Moment and Make Your Move

The Bank of Canada's decision to lower the overnight rate is a landmark event for the GTA real estate market. It's a clear signal of a new era, one defined by increasing stability and renewed opportunity. For buyers, this is the moment to act. The market is poised for a positive shift, and being proactive can put you in a position to secure your dream home with more favourable financing.

Call to Action: The time to strategize is now. Whether you're a first-time homebuyer or looking to upgrade, understanding how this rate cut impacts your personal financial situation is crucial. Contact us today to discuss your goals and create a plan to capitalize on this new market momentum.